What is a Judgment Lien – And Can I Get Rid of It?

A judgment lien is a document notifying everyone who looks at it or its record that a judgment creditor has a right to collect against your property.

Many people are surprised to see, especially when they are trying to sell their property, that a judgment lien had been recorded against their property previously. Sometimes, that person has already fully paid the debt, yet the judgment lien still exists on their property. These people often wonder, ‘what is a judgment lien’ and how do they get rid of it.

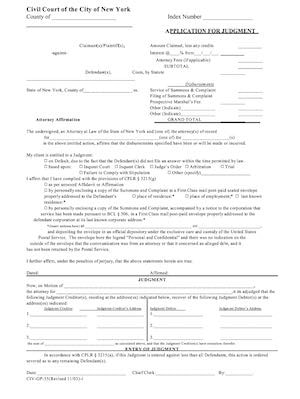

When a person (called the debtor) owes money to another person (called the creditor) and fails to pay, the creditor will file a case against the debtor in court to collect on the debt. When the court finds that the debt is valid and unpaid, the court issues a judgment in favor of the creditor. Once this judgment is entered, the creditor can now enforce the judgment in several ways. The creditor (now known as a judgment creditor) can execute on the income of the debtor (now known as the judgment debtor) if the judgment debtor is employed. In this case, a portion of the judgment debtor’s wages will be automatically paid to the creditor by the judgment debtor’s employer.

The judgment creditor can also request for personal property execution on the personal property of the judgment debtor, such as a truck, motorcycle, or car. The judgment creditor can also opt to levy the judgment debtor’s bank account, subject to an amount that is exempt from execution.

The judgment creditor can also record its judgment with the county clerk’s office and any land or real estate recorded in the name of the judgment debtor in that county will be subjected to that judgment. This is what a judgment lien is all about. Generally, once that lien is filed with the county clerk, the land cannot be sold unless the money judgment is paid. In rare cases where such land has been sold and the judgment debtor has not used the proceeds to pay off the money judgment, such judgment lien still exists against the new owner and the new owner has to pay the debt in order to release the property from the lien. Any judgment lien that is recorded puts the public into notice that such land is subjected to a lien.

For example, John borrowed $20,000 from his (former) friend, Michael, promising to pay after three (3) months. John did not pay. Michael made several attempts to collect from his friend, John, but John disappeared, did not answer his calls anymore, and was always not home. Michael then filed a case against John in the New York County Civil Court because he lived in Manhattan. John was sent summons, but he did not appear before the court. Michael was able to secure a money judgment against John. John owned a co-op in Manhattan, an apartment in Brooklyn, and a house in the Hamptons.

Does Michael have a judgment lien against John? No. He only has a money judgment. Since the case was decided by the New York County Civil Court, the lower court’s judgment transcript has to be filed with the county clerk in order for a judgment lien to be created.

Suppose that the debt was $55,000 and the case was filed with the Supreme Court of the county of New York, does Michael have a judgment lien against John by virtue of the same judgment of the Supreme Court? Yes, Michael has a judgment lien against John only for the co-op in Manhattan because the judgment was issued by the Supreme Court, and thus, the judgment was already entered by the New York county clerk. Michael, however, does not have a judgment lien on the apartment in Brooklyn or the house in Hamptons because he has not filed the judgment transcript with the county clerk of Kings (for Brooklyn) and Suffolk (for Hamptons).

In the first case above where the debt was $20,000 and the judgment was issued by the Civil Court, Michael had to record the judgment transcript with the New York county clerk in order to create a judgment lien over the co-op in Manhattan. To create judgment liens over the apartment in Brooklyn and house in Hamptons, Michael needed to record the same judgment with the Kings and Suffolk county clerks.

Could Michael have skipped recording the judgment with the New York county clerk and went straight to Kings and Suffolk county? No. The county clerks in Kings and Suffolk would not record the judgment if it was not initially recorded with the county clerk in the county where the judgment was originally issued.

Suppose that John sold the co-op in Manhattan to his other friend, Robert, for $150,000. Robert thought it was such a good deal that he didn’t bother checking the county clerk for any judgment liens. Robert paid John all in cash. John didn’t use any of the $150,000 to pay Michael. Is the co-op still subject to the judgment lien in the hands of Robert? Yes, the co-op is still subject to the judgment lien. In case Robert decides to sell the co-op, the title insurance company and/or bank will see the judgment lien during due diligence, and no buyer will purchase the property until the judgment lien is cleared.

Suppose that Robert did his due diligence and knows that the property is still subject of a mortgage with remaining balance of $135,000 and a judgment lien if $20,000. Robert agreed with John that the proceeds of the payment will be used to satisfy the property lien (by virtue of the mortgage) and the judgment lien first, and John agreed. Can Michael, the judgment debtor, demand that payment of the entire $20,000 be made to him? No, because the property lien of $135,000 is superior to the Michael’s judgment lien of $20,000. Robert should pay off first the $135,000 for the mortgage, and the remaining $15,000 shall be paid to Michael with a deficit of $5,000 which Michael can get from the other judgment liens in Kings and Suffolk counties.

Other Consequences of Judgment Liens

Aside from knowing what a judgment lien is, it is also important to know the other consequences of a judgment lien. Once a judgment lien is entered against the judgment debtor, the judgment debtor will find it difficult to secure a loan to buy a vehicle or a house because credit agencies always check county clerk records to see if the person has judgments entered against him. Credit card agencies also check county clerk records and a record of judgment lien can lead to the judgment debtor’s denial of an application for a credit card.

Statute of Limitations in Enforcing Money Judgments

To know what a judgment lien is is to know when a judgment lien expires. In New York, the statute of limitations in enforcing money judgments is 20 years. A judgment lien, once recorded, is valid for 10 years, and can be extended for another 10 years.

Suppose in the same example above, the judgment lien was recorded in 2000, and John sold the property to Robert in 2021. Can the judgment lien still be enforced against Robert? No, because the judgment lien already expired.

Defenses

When one wonders what a judgment lien is, they also normally ask how they can remove a judgment lien. One can remove a judgment lien in several ways: by filing for bankruptcy, claiming that the property is exempt from satisfaction of money judgment, sue the creditor in court to vacate or remove the judgment from the county records, or paying the debt.

In New York, there are several properties that are exempt from execution of a money judgment. Under New York Civil Practice and Law Rules (CPLR) § 5205 and 5206, several personal and real properties are exempt from satisfying a money judgment. Depending on the county, the homestead protection law exempts homes from execution in amounts ranging from $75,000 to $180,000, an amount which can double for married couples. This amount is adjusted every three years. Generally, judgment creditors don’t execute on homes of judgment debtors because the pre-recorded lien on an existing mortgage coupled with the homestead exemption can leave the judgment creditor with little to none, unless the judgment debtor has enough equity in the property to cover the judgment.

The judgment debtor can also totally evade the payment of the judgment lien by filing for Chapter 7 bankruptcy. The judgment debtor, especially if he did not participate in the proceedings before the court, can move to vacate the judgment or sue the creditor, claiming that the judgment was acquired through fraud, bad faith, coercion or other means. It is best to consult with an attorney with faced with the prospect of a judgment lien.

If you are wondering what a judgment lien is, you need to enforce a judgment, or to deal with judgment lien entered against you, we, at the law offices of Albert Goodwin, are here for you. We have offices in New York City, Brooklyn, NY and Queens, NY. You can call us at 212-233-1233 or send us an email at [email protected].