What is an Executor of Will – What they Do and How they Do It

An executor of will is named in the will as the person in charge of the estate. The executor of will is responsible for carrying out the wishes and intent of the person who made the will. They must act in good faith and by representing the best interests of the beneficiaries at all times during the probate administration of the estate and winding up and closing of an estate.

When choosing an executor, you should keep in mind qualities such as experience, ability to handle and manage business matters, competency and availability. You may appoint a spouse, another family member, friend, attorney or any other person over the age of 18 years of age to act as the executor. It is common to appoint a successor executor of will as a backup, just in case something happens to the executor of will by the time you die. Some people choose to appoint co-executors, to have more than one person be responsible to carry out their wishes.

The Executor’s Responsibilities

An executor of will can initiate the filing of a probate proceeding with the Surrogate’s Court by filing the original will and death certificate with the court and is responsible for obtaining and filing any other necessary documentation that the Court may require. An executor’s duties vary and may include the following:

- Managing the estate assets including bank accounts, stock, bonds, retirement accounts, pensions

- Taking inventory of assets, including personal and real property

- Investing assets

- Selling personal and real property

- Distributing assets

- Paying creditors and other claims including funeral expenses and any estate taxes that may be due out of estate assets

- Contacting an employer to find out about the testator’s employee benefits

- Managing the testator’s business

- Making accountings

- Communicate with the beneficiaries on a regular basis to keep them informed of important financial matters

- Resolving disputes that may arise between beneficiaries

- Winding up and settling the estate

There are all sorts of other contractual or legal matters that may require an executor’s attention. For instance, if the testator owned commercial property and had tenants, the executor of will may have to collect rents, work with a property management company or hire one depending on the size of the building and the number of tenants. The executor of will may have to work with attorneys and accountants in order to make sure assets are properly valued and contractual obligations are completed.

An executor of will is entitled to receive compensation for his or her services in accordance with the rates set by law. When a spouse or a family member acts as executor, many times they do not take compensation for their services, especially when they are also a beneficiary receiving a distribution of assets under the will.

Letters Testamentary

An estate executor of will is someone who is in charge of an estate due to being nominated in the will. Being nominated as an executor of will in a will in and of itself is not enough to start acting on behalf of an estate. One has to first go through the probate process and be appointed by the court and receive a legal document called “Letters Testamentary.”

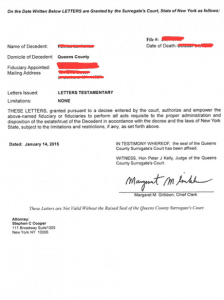

Letters Testamentary is a document has many safety features, such as watermarks. It looks similar to other New York documents that have to do with birth and death: Letters Testamentary look similar to a birth certificate or death certificate. The executor of will of estate will receive Letters Testamentary from the Surrogate’s Court. It which would look something like this:

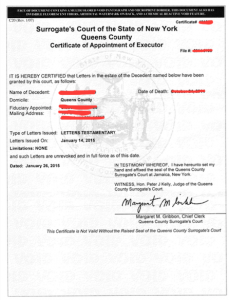

Once appointed, an executor of will will receive enough Certificates of Appointment of Executor of will to present to every bank and other institution when they marshal the assets of the estate. The Certificates of Appointment also have watermarks and security features. The certificates cost $6 each and can be obtained from the cashier in the courthouse. This is what a Certificate of Appointment of Executor of will would look like:

Preliminary Executor of a Will

If someone is objecting to the appointment of an executor, or the court is waiting for additional documents, but assets of the estate need to be taken care of, the court can issue preliminary letters testamentary, which give a person the power to take care of the estate assets but does not give them the power to disburse the assets to the beneficiaries of the estate.

In recent times, we have noticed that courts are more reluctant to appoint preliminary executors, as the extra work puts a strain on the court’s resources. We are trying to not apply for preliminary executorship unless necessary in the case.

Notice to All Heirs and Potential Heirs

An executor of will is required to give the proper notice to people affected by their appointment to that role.

A person who wishes to get appointed as the executor of will has to give notice of the probate proceeding to everyone who inherits under the will, relatives who would have inherited if not for this will, and people who would have inherited under a prior will that was overwritten by the current will.

Notice of probate is sufficient to people inheriting under the will. For people whose prior inheritance rights are terminated by the will, a citation issued by the court will be required.

In order to get appointed to be in charge of an estate, the potential executor of will will need to either obtain written waivers and consent of the people they notified or have to schedule a hearing date where the people notified of the date have a chance to appear and voice any of their reservations.

Affidavit of Sole Heirship

Whenever an executor of will is the sole heir of the decedent, they may be required to submit an affidavit of sole heirship, whereby a non-interested party who is familiar with the family of the person who died or a professional genealogist or perhaps even the attorney representing the executor of will who did the right research signs an affidavit which explains the family situation of the person who died and how it worked out that the person who died left only one heir.

Executor of a Will Commissions

Executors are usually entitled to compensation. This compensation is called “commissions.” The amount an executor of will is paid in New York is set by law, in SCPA 2307. Here are the commission percentages:

• 5% of the first $100,000

• 4% of the next $200,000

• 3% the next $700,000

• 2.5% of the next $4 Million

• 2% of the rest of the value of the estate

Fiduciary Duty of an Executor of a Will

An executor of will is held a higher standard of behavior and is expected to act in an honest, fair and ethical manner. If an executor of will breaches their fiduciary duty, the executor of will could be held legally liable for any losses suffered by the estate or beneficiaries. An executor of will in New York can be removed by the beneficiaries for breach of fiduciary duty and could be subject to restitution of any financial losses to the estate and beneficiaries, as well as face criminal charges if the executor of will committed any crimes such as embezzlement of estate assets.

Acting an executor of will is a big responsibility, especially if an estate is large and has substantial assets. That is why some spouses or family members decide they do not want to take on the job and end up resigning and hiring an attorney or another personal representative to replace them and administer the estate.

If you wish to speak to hire a New York estate attorney to assist you with your duties as executor, call the Law Offices of Albert Goodwin at (212) 233-1233.