A distributee is a legal term for a person who is entitled to inherit property from their relative who died without a will. New York Estates, Powers and Trust Law Section puts it this way: “A distributee is a person entitled to take or share in the property of a decedent under the statutes governing descent and distribution.” Quite intuitively, the noun “distributee” comes from the verb “distribute.” It connotes relatives to whom the estate is distributed unless overridden by a Will.

How is an Estate Distributed Between Distributees

How Much Does Each Distributee Receive? New York’s default intestacy rules, New York’s Estates, Powers and Trusts Law § 4-1.1 lists the order of hierarchy of the preferred distributees:

| Closest Living Relative | Who Gets the Estate |

|---|---|

| A spouse and issue | Fifty thousand dollars and one-half of the residue to the spouse, and the balance thereof to the issue by representation. |

| A spouse and no issue | the whole to the spouse |

| Issue and no spouse | the whole to the issue of the parents, by representation |

| One or both parents, and no spouse and no issue | the whole to the surviving parent or parents. |

| Issue of parents, and no spouse | the whole to issue of parents |

| One or more grandparents or the issue of grandparents. . . . | |

| Great-grandchildren of grandparents . . . . | |

| If there are no qualifying descendants | the estate escheats to the state of New York |

Once a higher priority exists, the allocation stops and the more distant relatives end up with nothing. So for example, if the person who died had a child, parents and siblings will not receive anything.

“Issue” means linear descendants – children, grandchildren, and great-grandchildren.

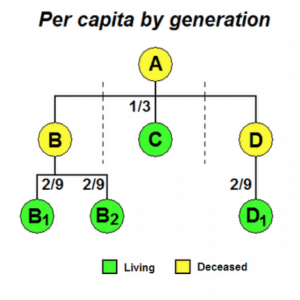

“By Representation means the same thing as “per capita by generation” – relatives at the same level of linear descent receive their shares equally, as illustrated below:

Can Any Distributee Become an Administrator of an Estate

Any distributee can petition for the administration of an estate, but the court will give preference to certain family members over others. This is not something that every distributee appreciates. For example, sometimes a child from the first marriage does not want the wife of the decedent to become their administrator. Having said that, the order of preference for each family member who could serve as administrator is listed in Surrogate’s Court Procedure Act § 1001, as follows:

1. The surviving spouse

2. Adult children

3. Adult grandchildren

4. Parents

5. Adult siblings

6. Distributees who would have the largest distribution under the estate

What Happens When Distributees are Left Out of a Will

A Will Controls What the Distributee Gets from an Estate. Can you be a distributee and still get nothing from the estate? Absolutely. If the relative who died left a will, the will controls what happens to the inheritance. A will can omit the distributee, expressly mention that the distributee does not get anything, or give a distributee a lesser share than other people in the will. The will overrides distributee distribution. The person who makes the will can disadvantage a distributee in any way they like, with notable exceptions, which we will discuss below.

Any Distributee Has the Right to Contest the Will. If they feel that the will was not made correctly or under the right circumstances. Any distributee has the right to bring a will contest in the Surrogate’s Court. It would be up to them to prove one of the will contest grounds below:

- The person who died did not have the mental capacity to make a will

- Beneficiaries manipulated the person who died into making the will

- The will is a forgery

- The beneficiaries obtained the will by lying

- The will was not made correctly

- The maker revoked the will

Special Rights of a Distributee Who is a Spouse. A spouse who’s had her inheritance diminished or eliminated by a Will has the right to a spousal elective share, or “right of election,” which is one-third of the estate. The distributee who is a surviving spouse has a time limit on filing a claim for the elective share. The time limit to apply for a spousal election would be within six (6) months of the appointment of a personal representative for the estate or two (2) years after the death of the testator, whichever comes first. The spousal election does not happen automatically, so if a spouse misses that deadline, she gives up the important right of election.

Kinship: Proving You are a Distributee

For a child or a spouse of a person who died, it is usually easy to prove that they are a distributee. All they need to do is provide a Marriage Certificate if a spouse or Birth Certificate if a child. It is relatively simple for a sibling as well. But for someone who is a cousin or a niece or nephew, the process can be more complicated. An affidavit of the family tree will be required. If a relative cannot be found, the Surrogate’s Court will require a report which outlines the due diligence that the existing distributees applied in finding other ones. If there is a disagreement over who the distributes are, or if the distribution is unclear, then a New York kinship proceeding would ensue, whereby the court determines the relationship of each person who claims to be a distributee.

My name is Albert Goodwin, I am a New York estate, guardianship, wills, trust and probate lawyer with over a decade of experience. If you need legal representation in an estate, you can give me a call at (212) 233-1233.