Life Estate Examples and Explanations in New York City

A life estate is an estate interest or an ownership interest in a property that lasts for the life of the life tenant. It occurs when a number of people own a particular property at the same time, and for different durations.

With a Life Estate deed, people deed real estate to another party, but reserve a life estate. It means they have the legal right to occupy the property until death their death. And upon death, the property passes to the beneficiaries. The property passes to the Remainder Owner or the Remainderman without a need for probate. Simply, it is a helpful tool used to avoid probate, maximize tax benefits and protect the real property from potential long-term care expense you may incur in your senior years. A common example of a life estate is when a parent (Life Tenant Owner) transfers a property to a child (Remainder Owner) for the life of the child (or visa versa). An ample discussion on this example is provided below.

There are two parties in a Life Estate: The Life Tenant Owner and the Remainder Owner. The holder of a life estate, called the Life Tenant Owner(s) has a full right to possess the property during their life, therefore she or he is allowed to possess and use the property, can collect rent and profits, and is responsible for the costs of maintaining the property. The Remainder Owner(s) automatically takes the legal ownership upon the death of the Life Tenant. The Remainder Owners have no right to use the property or collect income generated by the property, and are not responsible for taxes, insurance or maintenance, as long as the Life Tenant is still living.

Executing a Life Estate deed is a relatively simple process but should be properly done with the aid of your Attorney. A life estate deed is a tool that can help with estate planning especially for seniors in New York, who are in the midst of updating their estate plan or even undertaking one for the first time, the use of a life estate may be an excellent planning tool to discuss with your trusted Attorney.

Life Estate Examples

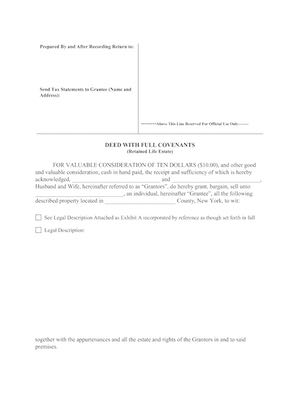

Here is what a life estate deed looks like:

Retaining the Right to Occupy the Property

When you grant a life estate, for example you deed your home, you basically reserve for yourself the right to retain, use, occupy and all the property rights (and obligations) that come with the home ownership. The property is wholly yours until you actually pass away. Upon your passing, the property will automatically transfer to the heir or “remainderman” you named on the deed. This transfers outright without the need for probate. Having it passed outside of probate it significantly reduce an estate’s legal and administrative fees. It is simple, quick and inexpensive to establish; merely requiring that a new Deed be recorded.

Still Qualify for STAR Exemption

Another advantage is that as long as the senior Life Tenant remains in the property, he or she continues to qualify for the STAR exemption, veteran’s benefits, and any other tax reduction available to the “owner” of the property. Upon the Life Tenant’s death, the heir or the Remainder Owner will receive the property in the current market value and not the price the Life Tenant paid for it. A favorable tax treatment upon the death of the Life Tenant when the property is titled in this way. The heirs or the Remainder Owner will enjoy a stepped-up tax basis, as of the date of death, for capital gains purposes.

Stepped-Up Tax Basis

Where the home has appreciated significantly, it will allow your heirs to sell the house within six months from the passing of the Life Tenant and no capital gains taxes will be due on the increased value. After that initial six month period, any increase in value over and above the fair market value assigned at the time of death will be subject to capital gains tax at the normal rate.

Medicaid Protection

Lastly, a property owned via a Life Estate is typically protected from Medicaid claims once 60 months have elapsed after the date of transfer into the Life Estate. After that five-year period, the property is protected against Medicaid liens.

A Life Estate can be beneficial for purposes of Medicaid eligibility and protection from Medicaid recovery by the state. For example, X, a 68-year old widower, owns a home in New York with a fair market value of $250,000.00. He wants to leave his house to his son. X has an advanced illness that renders him unqualified for long-term care insurance. Hence, he may have to apply for Medicaid as his health is not getting any better. X can execute a Life Estate deed that retains a life estate for him and the remainder to his son.

In this regard, the transfer to his son is not the property’s fair market value mentioned above. The value of the transfer of the remainder to the son is calculated according to tables used by the Department of Social Services. DSS limits the house is .37914% of the fair market value of $250,000.00 or $94,785.00. If X had simply conveyed the house to her son she would not be eligible to receive Medicaid until 3 years or 36 months from the date the deed is executed. But by retaining a life estate, X will be eligible to receive Medicaid after only 14 months have passed form the date of the execution of the Life Estate deed.

Life Estate is a recognized “limited interest in real property.” The New York State Department of Social Services recognizes and respect Life Estate deeds. The state will not require X to sell the property, nor will the state place a lien on the property as a condition of Medicaid paying a nursing home for his care.

In short, New York Medicaid laws and regulations limit recovery to probate assets of the Medicaid recipient or his surviving spouse (in our example X is a widower). Since the life estate expires upon X’s death, the property passes to his son out of probate and is therefore not recoverable by the state.

The term Life Estate is likely something one never considered and may seem foreign for the uninitiated, with examples far and few in between. However, contrary to any first impressions that it may cast, when properly used, a life estates can be a powerful tool used not only preserve one of your most valuable and important asset, your home, but also simplify its transfer when you pass away.

When it comes to planning for your future and the disposition of your assets, it is necessary to consider your options. Life Estate is only one of many estate planning and asset preservation tools. Most people prefer to make the process as simple, quick and cheaper. The question is, “is it for everyone?” Certainly not. While a Life Estate can be beneficial when it comes to Medicaid purposes, those individuals with larger estates and significant estate tax exposure should consider other routes. But before undertaking any strategy, it is critical to consult with your Attorney who can give you proper advise when it comes to potential expenses and other tax consequences, such as capital gains tax, estate taxes or gift taxes, also as regards to Medicaid and other estate administration laws applicable to your personal circumstances.