Not Reporting Man's Income for Snap in New York

Even if the man claims to live somewhere else, this is not something that the city believes. The family can claim that the man lives with his mother or father or sister or brother, etc., or that he's renting a room in someone apartment, or lives in the same house but in a different part of the house or on a different floor, none of that matters to the city.

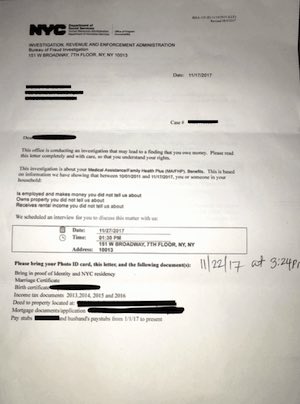

By the time the mother gets a letter informer her that the city knows about the father's income, they typically already have a copy of an income tax return with the father declaring the children as dependents and listing the woman's address as his address, and they typically have a copy of the man's drivers' license with the same address as the woman listed on the application for SNAP or Medicaid. They also have surveillance footage where the man enters the house in the evening and leaves in the morning.

If you received a letter from the Human Resources Administration Bureau of Fraud Investigation Department of Social Services, it is important to speak to an attorney to understand your options.

When determining SNAP or Medicaid eligibility, the program considers each household member's income and expenses separately. This means that even if one family member is employed and earning a relatively high income, the household may still be eligible for benefits if other members have low or no income.

For example, consider a household consisting of a working parent, a non-working spouse, and two children. While the working parent's income may be above the gross income limit, the household's net income after deductions (such as childcare expenses) could still fall within the eligibility threshold.

It's important to note that the definition of a "household" for SNAP purposes may differ from traditional family structures. Individuals who live together and purchase and prepare meals together are generally considered one household, regardless of their relationship.

Individuals and families have certain rights that must be respected during the food stamp (SNAP) investigation process. These rights are designed to protect applicants and recipients from unfair treatment, ensure privacy, and provide avenues for appeal. This is why it is important to have a qualified attorney advise you in the process.

If you have concerns or need further assistance, the Law Offices of Albert Goodwin can provide you with personalized guidance. We are located in Midtown Manhattan in New York, NY. You can call us at <a href="tel:+12122331233">212-233-1233</a> or send us an email at <a href="mailto:[email protected]">[email protected]</a>.