If you’ve come across a trust in a will, then you would have seen both an executor and a trustee in the same will. You must be wondering then, “what is a trustee in a will and how different is the trustee from the executor of a will?”

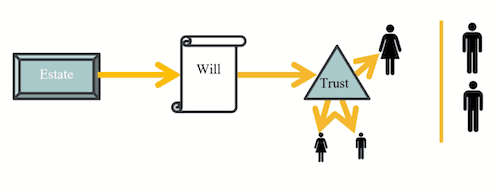

A trustee in a will is the person appointed by the testator (the person writing the will) to administer his or her testamentary trust. An executor in a will is the person appointed by the testator to administer the estate and distribute his assets.

What is a testamentary trust?

A testamentary trust is a trust created in a will that becomes effective after the testator dies and the testator’s will is admitted to probate, unlike an inter vivos trust which is created while the grantor is still alive and becomes effective upon transfer of assets to the trustee.

Who are the parties in a testamentary trust?

The parties in a testamentary trust are similar to an inter vivos trust: the grantor/settlor, the trustee, and the beneficiary/ies. The grantor/settlor is the person who establishes the trust, also the testator. The trustee in a will is the person appointed by the testator to administer the trust. The beneficiaries are the persons for whose benefit the trust was established.

In a testamentary trust, however, unlike in an inter vivos trust, there is a fourth party: the court. It is the court that creates the testamentary trust by admitting the will to probate. If the will is not admitted to probate, no testamentary trust is created.

Differences between a testamentary trust and a living trust

| Trust that’s a part of a will | Trust made and used during lifetime | |

|---|---|---|

| Creation | By will | A private document |

| Parties | Grantor/settlor/testator, trustee, beneficiary, court | Grantor/settlor, trustee, beneficiary |

| To be effective | By court – admission of the will to probate | Transfer of properties to the trustee |

| Monitoring | Requires court monitoring | No court monitoring |

| Initial cost | Cost of creating a will | Cost of establishing a trust plus transferring properties to the trustee |

| Other costs | Probate fees, periodic court fees for trust monitoring | No other costs |

| Flexibility | No flexibility because it is already irrevocable when the testator dies | More flexible |

| Modification | Execution of another will or codicil | Amendment of the trust agreement |

| Probate | Requires probate | Does not pass through probate |

Differences between an executor and trustee

| Trustee | Executor | |

|---|---|---|

| Fiduciary | Yes | Yes |

| Duty | Administer the estate | Settle debts of deceased and distribute the estate |

| Period of performance of duty | Depending on trust agreement, the maximum in New York is 21 years after the death of any living beneficiary named in the trust | Distribution of estate assets begins 7 months after letters are issued and creditors’ time to file claims has expired |

Differences between a trustee of a living trust and testamentary trust

There are generally no significant differences, aside from what is stated as their powers in the trust agreement or will since both are fiduciaries.

Why would a testator create a testamentary trust?

Given the differences above, there are still many reasons why a testator would create a testamentary trust. Testamentary trusts are used for the benefit of charitable organizations or pets. Most often, however, it is used when the testator dies with minor or disabled children.

A trust is created in the will (the testamentary trust) where the deceased’s property is transferred to a trustee and administered by the trustee until the happening of an event, usually when the children reach a certain age and are old enough to manage the assets for themselves. If no trust is created, the court would have to appoint a legal guardian for the children who will take custody of the property until the children attain the age of majority.

Most people think that a testamentary trust is more cost-effective because it is created by a will. The will and the trust are in one document, and you only have to pay the legal fees for the preparation of one document. However, if you add up the probate costs and the court’s periodic monitoring of the trust after your death, an inter vivos trust might turn out cheaper.

A testamentary trust, as opposed to an inter vivos trust, also has limited applications because it passes through probate. For example, in multi-blended families where spouses are in their second or third marriages, a spouse with real property can transfer property to an inter vivos trust more than one year prior to death and this property will not be included in the computation of the spousal elective share. The inter vivos trust can name the current spouse as a lifetime income beneficiary with the remainder going to the children after the current spouse’s death. If this was written in the testamentary trust, the spouse can invalidate such provision on the ground that the spouse’s elective share must first be satisfied.

If you’d like your property to be free from the Medicaid estate recovery program, the asset in the testamentary trust will still be counted by Medicaid as part of your estate and will be subjected to Medicaid reimbursement, unless it falls under certain exceptions. On the other hand, property transferred to an inter vivos trust, when done correctly, can be made out of reach from Medicaid recovery.

Still, a testamentary trust can provide the grantor a level of control over his property. But this can also be achieved with a revocable inter vivos trust.

The main significant difference between a testamentary trust and an inter vivos trust would be the cost of setting it up, which makes the testamentary trust in that aspect cheaper.

How is the trustee in a will different from all other trustees?

Aside from the fact that the trustee was created by virtue of a will, there are no significant differences between a trustee in a will and all other trustees. The same law applies to them. They are also subjected to their fiduciary duties. The trustees’ level of powers and discretion will depend on the trust agreement or will that created the trust. For this reason, the same level of meticulousness and detail a lawyer spends on the drafting of an inter vivos trust should be similar to the drafting of a testamentary trust.

Ultimately, deciding whether to create a testamentary trust and have a trustee in the will depends on the testator, given all the differences, advantages and disadvantages, and the purpose of creating the testamentary trust. The best reason to create a testamentary trust is to provide for minor or disabled children, pets, or charitable organizations. Otherwise, creating an inter vivos trust and a pour-over will which gives the remainder of your property to the trust might be a more cost-effective decision because the court will not be a party to the trust.

Should you need help in drafting a testamentary trust or seek counsel to advise you on the proper way to plan your estate, we at the Law Offices of Albert Goodwin are here for you. We have offices in New York City, Brooklyn, NY and Queens, NY. You can call us at 212-233-1233 or send us an email at [email protected].