Do New York Attorneys Take Estate Cases on a Contingency?

Contingency fees are not common in New York estates, but it is possible for an estate attorney to take a case on contingency if it’s the right kind of case. The following factors will make it more likely for a case to be accepted by an estate attorney on a contingency basis:

- the attorney thinks that he has a good chance of actually winning the case

- the estate must be large enough to justify the risk of the attorney getting paid nothing from the estate

- there are sufficient cash or liquid assets to pay the attorneys’ contingency percentage

- the client seems agreeable enough to accept a settlement

- the client’s personality is pleasant enough for it to not be obvious why they were disinherited

- the client is either a sibling of the person whom they are suing (easier to settle with siblings) or

- the client is a relative and the person whom they are suing are a friend, neighbor or caretaker (relatives have more bargaining power

- a cousins case is not a good candidate for a contingency

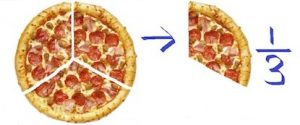

In a contingency case, the attorney takes a percentage if they win the case, nothing if they don’t. The percentage is usually high, around 1/3 of the recovery. This is not to be confused with a flat-fee percentage case, in which an attorney takes a smaller percentage (around 6%) of the estate which is risk-free probate or administration of an estate.

Advantages and Disadvantages to Client

| Type of Fee | Advantages to Client | Disadvantages to Client |

|---|---|---|

| Hourly Fee | You know how much you’re paying for each hour of attorneys’ work. You get a minute-by-minute statement of how much work is done. | Even though most lawyers are conservative in their billing practices, many clients still have a perception that they have no control of the amount of time and money being spent on their case. |

| Flat Fee | You know exactly how much you are paying. | Not offered for contested cases. Uncontested cases may be cheaper if you pay by the hour. |

| ContingencyFee | If you lose, you don’t pay anything. | If you do win big, then it would have been much cheaper to pay by the hour. |

Advantages and Disadvantages to Attorney

| Type of Fee | Advantages to Attorney | Disadvantages to Attorney |

|---|---|---|

| Hourly Fee | Attorney gets paid for their time. | In a big case, a contingency win would have netted a bigger fee. |

| Flat Fee | The attorney is guaranteed a set amount. | The attorney can be in a situation where they would have to perform more work than anticipated |

| ContingencyFee | If the client wins big, the attorney gets to share in the reward | If the case loses, the attorney gets nothing for their time. |

Ask a New York probate and estate attorney at your initial consultation about the attorney’s compensation and fee arrangement, the type of services which will be performed and whether he or she would consider taking your estate matter on a contingency fee basis. However, keep in mind that a contingency fee is not always the best arrangement – you may be saving money by going with the hourly arrangement.

Here’s our article explaining the different types of attorneys fees in New York.

Statutes Regarding Attorney Compensation in Estate Matters

In any probate matter coming before the New York Surrogate’s Court, the Court has the jurisdiction to approve the attorney’s fees or compensation for the allowance of expenses of legal counsel whenever a petition and affidavit of services is filed stating when and by whom the attorney was retained, the terms of a retainer agreement, the amount of compensation requested to be paid and whether the client has been advised concerning the same and consents thereto. Under Section 207.45 of the New York Statutes, the Court shall not fix the attorney’s compensation unless there is a reason to do so or an action is filed under SCPA 2110 requesting the Court to make such a determination.

One Appellate Division Ruling Reducing an Excessive Contingency Fee Arrangement in Estate Case

It is important to understand your fee arrangement with your estate attorney. Hiring an estate attorney on a contingency fee basis may not be an advantage to you. Take, for example, the recent decision handed down by the New York State Appellate Division ordering a law firm to reduce their fees owed by the estate of Alice Lawrence from $44 million to approximately $2 million.

The circumstances surrounding this estate case are as follows:

Before her death, Alice Lawrence, the widow of commercial real estate mogul Sylvan Lawrence, hired a law firm to represent her in a litigation estate matter against the executor of her husband’s estate. The law firm convinced the 80-year-old Mrs. Lawrence to enter into a revised agreement to pay the firm a 40% contingency fee instead of an hourly fee arrangement. The firm negotiated a $111 million dollar settlement with $44 million owing to the law firm, which calculates to roughly $11,000 an hour.

The court found that the firm failed to show that Mrs. Lawrence fully knew and understood the terms of the new fee arrangement and ordered that the Lawrence estate be charged the old hourly rate instead of the 40% contingency fee, which would reflect approximately attorney’s fees in the amount of $2 million including interest.

If you are involved in a New York estate matter and need to hire an estate attorney, it is suggested that you discuss the fee arrangement with the attorney prior to signing any fee arrangement/retainer agreement and that you fully understand the terms of the agreement.

If you wish to speak to a New York estate attorney, call the Law Offices of Albert Goodwin at (212) 233-1233.