What is a Totten Trust/Payable on Death Account

A Totten trust (payable on death account) can be used for financial accounts that hold cash such as bank accounts, stocks, bonds, or U.S. Treasury securities in order to avoid formal probate or to pay a decedent’s funeral expenses. Totten trusts are typically bank accounts established at financial institutions. An account holder opens the Totten trust account (payable on death account) under the account holder’s name for the benefit of a named beneficiary. The account holder has full use of the account to add or withdraw funds, change beneficiaries or close the account at any time. The beneficiary does not have any authority to use the funds during the lifetime of the account holder. Upon the death of the account holder, the funds automatically transfer to the beneficiary without having to establish formal probate with the Court.

Although a Totten trust acts similar to a formal trust because assets pass automatically to the beneficiary outside the estate, it is not the same because it is not a formal trust, and there is no trustee. Also, the funds in a Totten trust may be subject to creditor’s claims by the decedent’s creditors, unlike funds transferred to an irrevocable trust and held in the name of the trust for the benefit of the beneficiaries, which are protected from the decedent’s creditors.

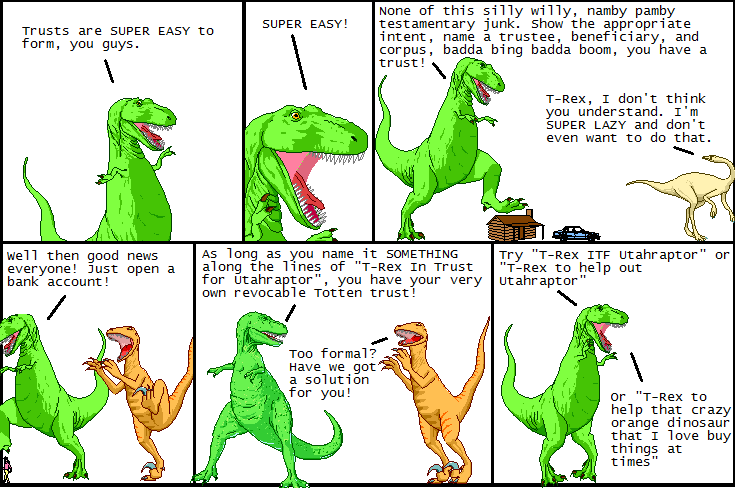

Establishing a Totten Trust/Payable on Death Account

To establish a Totten trust, you simply open a financial account at a bank, credit union, stock brokerage company or with another financial institution of your choice under your name for the benefit of your beneficiary. So for example if John Smith wants to open an account for Mary Jones, his significant other, Mary’s name may be on the account as “in trust for”, but she would not have any rights to use of the funds until John Smith passes away.

As the account holder of a Totten trust, you are free to use the account funds by adding or withdrawing funds, changing beneficiaries or closing the account at any time, without advising your beneficiary because your beneficiary has no legal ownership rights to the account until after your death.

The primary advantage of using a Totten trust is that the funds transfer to the beneficiary without the need to establish probate with the New York Surrogate’s Court. The account is insured by the FDIC up to $100,000 for each named beneficiary and separately from any other accounts held under the account holder’s name at the same institution. Another reason that Totten trusts are set up to pay funeral expenses for the account holder. When the account holder dies, the funds are paid to the beneficiary so that the beneficiary can use the funds to pay for the decedent’s funeral expenses. This avoids the beneficiary having to use the beneficiary’s own funds to pay for the decedent’s burial and funeral expenses.

The major disadvantage of a Totten trust/payable on death account is that creditor’s claims submitted by the decedent’s creditors must be paid first before the beneficiary is entitled to receive any funds from the Totten trust account. This means that there is a chance that the beneficiary may not receive any of the funds if the decedent dies insolvent (owing more debt than the value of assets), or may receive a reduced amount minus any funds that are used to pay the decedent’s creditors.

While Totten trusts are an effective way to leave cash, stocks or bonds in a financial account to a beneficiary after you pass away without your family having to establish a formal probate, it is advisable that you also have a will and/or trust, health care proxy and power of attorney in place as part of your estate planning strategies. A qualified and experienced New York Estate attorney can assist you with all your estate planning needs and answer any questions you may have regarding Totten trusts.

If you wish to speak to an attorney, give me a call at (212) 233-1233.