Nine Tips for Beating a Medicaid Fraud Investigation in New York

Plus the five things that you should never do in a Medicaid fraud investigation

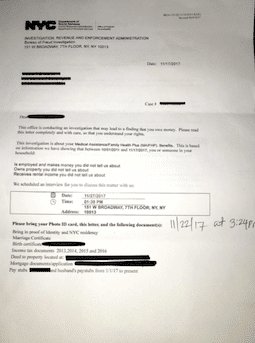

You received a Medicaid fraud investigation letter in New York City. You are worried about what’s going to happen next. Here are some time tested and battle-worn tactics that lawyers use every day to beat Medicaid fraud investigations.

We recommend that you not use those tactics without being represented by an experienced Medicaid fraud attorney, as they can backfire if not executed correctly.

If you were contacted by the Department of Social Services Bureau of Fraud Investigation, the most important thing to do is to not panic and not call the investigator. Instead, it makes sense to discuss the situation with an attorney. The consultation is free.

If you would like to discuss the letter with me personally, feel free to call me anytime at 212-233-1233. I am a private attorney. I don’t work for the government. Everything you say to me is confidential by law.

As a Medicaid fraud lawyer in New York City, I’ve helped many families out of difficult situations. My clients are typically accused of not reporting income or not reporting the man of the household on their application and recertification for welfare benefits. If you think you may be in that kind of situation, and you are being contacted by the Bureau of Fraud Investigation, then you may benefit from information I present in this article.

Don’t go to the interview, send an attorney instead

If the HRA already has the information, why are they asking you to come to the interview? Likely to interrogate you to get more damaging information that they can then use against you.

Do you want to be involved in a real-life reenactment of a good cop-bad cop routine?

If the HRA has sent you a Medicaid fraud investigation letter, they have much to gain from you coming to the interview. It would be to their advantage for you to dig yourself into a deeper hole and to land yourself into further trouble. A successful interrogation will give them the option to refer your case to the District Attorney’s office for a ready criminal prosecution with all the evidence already in their hands and will provide them with the negotiating advantage to demand more money from you.

The Bureau of Fraud investigation can trick you. If you carefully look at their “frequently asked questions,” you can spot the incomplete “answers” that are more harmful than helpful. For example, they say that you can come in by yourself and that you have the right to have someone appear with you. What they do not say is that you also have the option of not coming to the first hearing at all. You can have your attorney appear instead. By using that “hidden option,” you avoid the unpleasantness, waste of time and potential exposure associated with meeting with an investigator.

Do not think that you can come to the interview, and a lawyer can fix your case later if things don’t work out. Once you’re in the HRA interrogation room without a lawyer, the HRA will find ways to make matters worse for you. It’s their job.

At the same time, do not just ignore the Medicaid investigation target letter. Do not wait until the date of the hearing. If you fail to show up or send an attorney, they will escalate your case for criminal prosecution. If you ignore the HRA and keep them in the dark, they will refer the case to the Office of the District Attorney for criminal prosecution. Instead, have an attorney notice the Bureau of Fraud investigation and adjourn the hearing. Saves you the unpleasant meeting but keeps you out of harm’s way.

An attorney will do their best to prove that the allegations have no basis

Proving them wrong is easier said than done. If you’ve received a Medicaid investigation letter, it is likely is that you were not eligible for Medicaid and misrepresented some information or made a mistake on the Medicaid application.

However, the HRA knows that they’ve set some flags too broadly. Your Medicaid fraud lawyer may be able to convince the HRA that you were flagged without cause. You may be innocent of Medicaid fraud. If that’s the case, they will not proceed further with the investigation.

An attorney will do their best to show that the District Attorney would have a hard time proving this case

Your Medicaid fraud attorney may be able to show the HRA that the District Attorney will not take their case. If that happens, the HRA will lose a lot of the leverage that they were planning to use. They will no longer be able to strong-arm you into settling for a large amount.

There are technical and legal reasons why evidence the HRA has obtained may not be admissible in court. Once convinced that they will have no case in the criminal court, the HRA may let you settle for pennies on the dollar, or even drop the case entirely.

An attorney will do their best to carefully controls the flow of information

The HRA may have had a flag go off but may have been unable to get the proof they need. Maybe that is why they are calling you in for interrogation. By not giving them the information, you may put them into a Catch 22, to your benefit.

However, this is something that you have to do the right way and with the assistance of an attorney. The last thing you want to do is lie to the HRA. Do not lie to them. They can easily escalate the investigation or refer it to the Office of District Attorney because you were lying to them. On the flip side, you may also make a mistake and provide information that would further incriminate you. This is why the best way to control the flow of information is to have an attorney handle your case.

An attorney can sometimes show that you were eligible for a partial period

Just because the HRA found income does not mean that the income or asset was always there. Your Medicaid fraud attorney can try to prove that you were eligible until your income grew or you’ve acquired the asset. For example, if you show that you were eligible for 4 months out of the year, you will automatically get a 1/3 reduction in the amount of the claim.

An attorney can sometimes show that at least some of the recipients in question were eligible

Your Medicaid fraud lawyer can try to show the HRA that some of the members of your household qualified for Medicaid. Your lawyer can also show that some of your family members would have qualified for other government insurance, such as Family Health Plus or Child Health Plus. This is especially true for children, who in some situations qualify for Child Health Plus even if the family is not eligible for Medicaid.

An attorney can challenge the amount of the claim

When it comes to medical costs and billing, there may be leeway in the amount that the HRA can charge for the services or insurance payments. There may be even more leeway over late fees, penalties or interest. You can look at factors such as which family members are covered and for which periods, to get to the lowest possible amount.

An attorney will do their best to understands what the investigator already knows

The investigator is working for the government. As such, they have access to any information available about you in any government or private database. The DSS runs many programs that assemble data about everyone and compare that data against a database of names and social security numbers of people who receive Medicaid. If any information about you or members of your household that exists in any government database, assume that the HRA will have it. Think about things like W2 forms, 1099 Forms, income tax returns, bank statements, any income you get from anywhere, and any record of property ownership, even if not in New York State.

The HRA also has investigators who work in the field. You should assume that they know where you live (and who owns that house), where you work (and who owns the business), where your children go to school.

The HRA may have that information. But then again, they may not. Figuring this out with the help of an experienced attorney can make all the difference in your case.

An attorney settles before the case gets escalated

The HRA sent you an investigation letter because they have evidence of Medicaid fraud. The HRA has an incentive to settle cases. Does the State of New York get money from processing you and opening up a criminal case, or even sending you to jail? No. You need your Medicaid fraud defense attorney to convince the HRA that what’s done is done, and the best move for them is to give you a break and help you cut a deal with them.

If you fail to settle the case on time, the Bureau of Fraud Investigations can escalate the matter by referring it to the District Attorney’s Office for criminal prosecution. Also, they can refer your case or to a private law firm working for the government, which will sue you in for money civil court. Once that happens, it will be harder to deal with the case.

We may be able to help you get into a settlement agreement with the HRA where you may accomplish the following goals:

- pay back less than what the government has spent

- spread out the payment over seven years

- get a 25% discount on the total payment amount

- and have an agreement to not have the case referred to a civil lawsuit or criminal prosecution

Now to the things that you should never do in a Medicaid fraud investigation, so as to not make your situation worse.

Do not ignore the Medicaid fraud investigation letter

The investigation will not just go away. The longer you wait, the worse it will get. If you ignore the letter, the HRA will escalate your case and will refer it to the District Attorney’s office for criminal prosecution. You need to take the chance you have and make the best of it.

Do not just show up for the interview

It’s not the time to play the hero. You may think that you are smarter then the investigators, but you cannot argue with the fact that they have more experience. Once they get you into a trap, it will be hard to get out. Once they’ve sent you a Medicaid fraud investigation letter, they are likely to have compelling evidence. Don’t take the chance. Speak with a lawyer.

Do not lie to the investigators

There is a difference between not volunteering information and providing false information. Providing false information to the investigator can come with a severe jail sentence.

Don’t think you can fool HRA investigators. They probably already have the evidence they need. They have whatever information triggered the investigation. That’s why they have sent you an NYC fraud investigation letter. They’ve probably interviewed the institution where that information came from, such as a bank, school, place of work, or government agency. They probably already have documents that show that you are not eligible.

On the flip side, maybe the HRA does not have enough information, so they are trying to get it from you. But it is also possible that they are trying to get you to lie, to add obstruction of justice as an extra criminal charge. You don’t want to be taking those chances.

Look at the recent high-profile convictions. Most of them had to do with lying to the investigators, some even more than the underlying fraud.

You have the right to remain silent. But not to lie.

Do not just pay the amount the DSS is asking For

Don’t let the DSS HRA scare you and intimidate you into paying them the full amount they are demanding. An attorney can use professional techniques, legal rules, their charisma and the fact that they not as emotionally invested as you are to

- try to not have you make any payment to the HRA for Medicaid or SNAP, if possible

- lower the amount you’ll have to reimburse the HRA for Medicaid or Snap

- Get a 25% discount

- Spread the payments into a seven-year installment plan

We have obtained excellent Medicaid Fraud settlements for our clients and will do our best to do the same for you.

Do not handle the case yourself

You need to find an attorney with the charisma to negotiate with people. You need a lawyer who is respectful and can relate to the overworked and underappreciated HRA investigators and their staff. You need someone who is a tough negotiator, but also someone who knows when to stop pushing. After all, the HRA thinks that they’ve caught you with your hand in the cookie jar.

When we handle a Medicaid fraud case, we aim to avoid escalation of the case. We restrict the amount of information that the HRA receives to the bare legal minimum – as close to nothing as possible. We argue partial eligibility.

These strategies help us beat the investigators at their own game and achieve reasonable outcomes for our clients. We also help you avoid making terrible mistakes, such as covering up the investigation with more fraud or ignoring the inquiry. The Investigation Revenue and Enforcement Administration Bureau of Fraud Investigation has professionals working for them. You need to have professionals working for you.

The strategies here apply to Family Health Plus and Child Health Plus investigations as well.

See our most Frequently Asked Questions about DSS/HRA fraud investigations.

If you are being investigated by the DSS/HRA, contact an attorney immediately.

I am a Medicaid fraud lawyer. I can speak to the investigator on your behalf and negotiate the best possible outcome for your case. I will be happy to provide you with a free consultation. You can call me at 212-233-1233 or send me an email at [email protected].