New York Resident Trust vs. an Individual Tax Rate

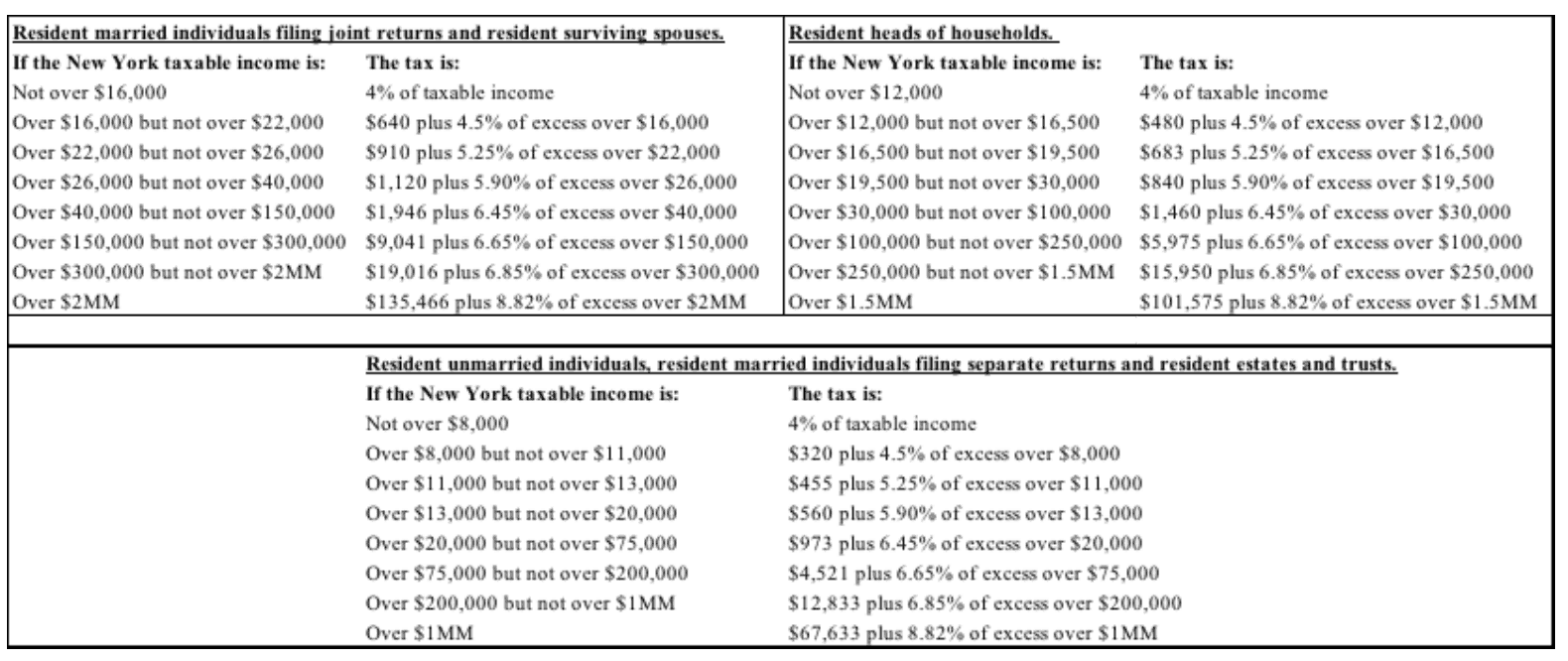

This post looks at the New York State (NY) treatment of trusts and compares it to the tax treatment of an individual. The memo solely compares NY tax rates of individuals and of a trust, and does not analyze the Federal Tax Code. First, it is essential to understand which trusts are bound by NY tax laws. Section 605 of the New York Tax Code (Tax Code) defines the resident trust. The trust is considered a NY resident if (A) a domiciled decedent dies and the trust transfers via a will (testamentary trust); or (B) the trust grantor was domiciled in NY at the time the trust turned irrevocable (inter vivos trust). Due to constitutional concerns, there is an exemption from NY taxation if the connection [1] to New York of the resident trust is tenuous. Therefore, it may be beneficial in setting up an out-of-state trust or in some [2] cases “moving the administration and the trustees out of the State”.[3] In the case of a NY Trust, the Tax Code treats a trust in the same way as resident unmarried individuals, married individuals filing separate returns, and estates. Compare the below charts for the 2019 tax year from Section 601 of the 4 Tax Code.[5]

Based on the above chart, the tax rate of a NY resident trust is higher than those of married individuals filing jointly, surviving households, and of the resident heads of households. Moreover, a trust cannot take advantage of the state’s standard deductions as could individuals. Section 619 of the Tax Code, however, allows for some itemized deductions.[6] Moreover, beyond the scope of this memo are potential additions or subtractions to the trust’s taxable income.[7] In NY, trusts are seemingly taxed at a less-favorable rate. For example, a trust with $2MM in taxable income pays $155,833 in State taxes, compared to $135,466 that married individuals filing joint returns would pay. Thus, such tax consequences should be considered in the cost/benefit analysis when contemplating creating a NY trust.

Call the Law Offices of Albert Goodwin at (212) 233-1233, New York estate, guardianship, wills, trust, Medicaid and probate lawyer, and make an appointment to discuss your tax situation.

[1] Tax Law § 605(b)(3)(B)–(C).

[2] Id. § 605(b)(3)(D); See also Mercantile-Safe Deposit & Tr. Co. v. Murphy, 15 N.Y.2d 579, 581 (1964) (affirming lower court’s decision that that “the imposition of a tax in the State in which the beneficiaries of a trust reside, on securities in the possession of the trustee in another State, to the control or possession of which the beneficiaries have no present right, is in violation of the Fourteenth Amendment”).

[3] Eileen Caulfield Schwab & William P. LaPiana, The Income Taxation of New York Resident Trust, 68 N.Y. St. B. J. 30 (Mar./Apr. 1996).

[3] Tax Law § 601(c).

[4] Id. § 601(a)–(c).

[5] Id. § 619(b).

[6] Id. § 618.