How to Establish Proof of Kinship in a New York Estate

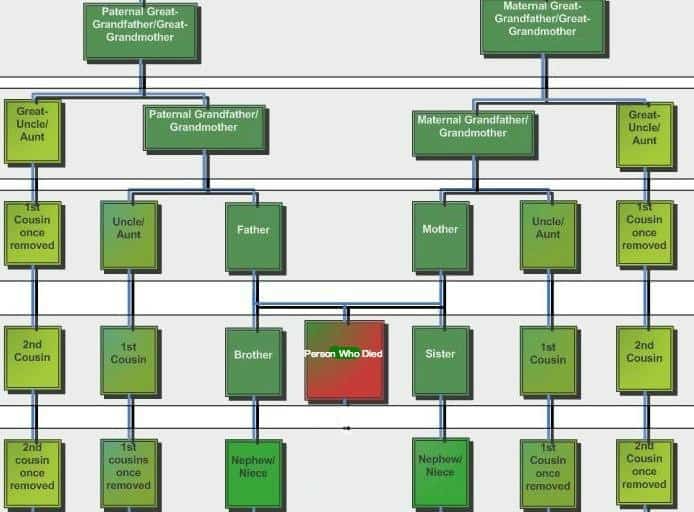

You are trying to establish proof of kinship in New York, because the court is not releasing your inheritance unless you do so. Likely, the person who died did not make a will, and you are their niece, nephew or cousin. The money is held by the Public Administrator, the Court or the Department of Finance. The government will not release the funds unless you prove that you are related to the person who died and that no other relatives have a better claim than you.

Kinds of Documentation Required

To prove kinship, you will need to put together your family tree. You will need to obtain written affidavits and oral testimony of friends and family. You may require the help of professionals such as genealogy experts and estate attorneys.

You will have to show the court how you are related to the decedent. A testimony letter should include information regarding surviving heirs as well as predeceased heirs of the decedent. You may have to provide information about

- maternal and paternal grandparents

- parents

- siblings

- children

- grandchildren

- nieces and nephews

- aunts and uncles

You would have to include their dates of birth and dates of death and other relevant information. The testimony letter should be signed and acknowledged before a notary public.

Some of the documents you will have to submit are

- birth certificates

- death certificates

- marriage records

- census records

- obituaries

- internet database entries

- other documents that prove your relationship

In kinship cases, there are usually no close family members such as a surviving spouse, children, grandchildren, parents or siblings of the decedent. You are likely a niece, nephew, cousin, or a distant cousin. It would be a complicated project for you to prove kinship and exclude other possible classes of relatives.

What Happens at the Kinship Hearing

Prior to the kinship hearing, your attorney can put together all of the evidence proving your relationship to the decedent. You may also have a report of a private investigator and a genealogist to help you with your proof. You may have DNA test results.

At the hearing, your attorney will argue that you are related to the decedent. There may be counter-arguments from other interested parties. The court will review the documentation, listen to the testimony and determine whether you have the right to the decedent’s assets. If the court is satisfied with your argument, the court will issue an order directing the Public Administrator or the Department of Finance to disburse your share of the estate to you.

Why Do I Need to Prove of Kinship?

Because your relative died without a will and is only survived by distant relatives, New York law mandates that the Public Administrator is assigned and a guardian ad litem is appointed to represent the interest of unknown heirs. New York law also requires that distant relatives establish proof of kinship.

Article 4 of the New York’s Estates, Powers and Trusts Law governs intestate rules.[1] NY default distribution rules prioritize the potential beneficiaries by consanguinity.

- If the decedent had a spouse and children, then the spouse receives $50,000 plus half of the remainder, shared with deceased children

- If the decedent was survived by a spouse, the spouse gets the entire estate

- If the decedent was survived by children, the children get the entire estate

- Parents inherit when there is no children or spouse

- And if no parents, spouse or children—to each sibling and their lineage, nieces and nephews

- Next is grandparents and lineage of their children (the aunts and uncles)

- followed by the great-grandchildren of grandparents—including first cousins once removed

Since the distribution of an estate is dependent on lineage, it is possible that the relationship can get even more tenuous than a first cousin. In New York, half-blood relatives get the same share as whole blood. Children conceived by the decedent but born after death are treated in parity with other children, and that the rules for adoptive children are governed by a different statute.[2]

New York courts are suspicious of tenuous relationship claims and make all distant relatives submit rigorous proof of being related to the decedent.

The courts take their time before allowing for the distribution of any assets. The state cannot release the estate prematurely, lest a closer-kin exists.

There could be cousins from various sides claiming parts of the inheritance, for example, from the mother’s side, and the father’s side. From the mother’s mother’s side and the mother’s father’s side, etc.

The State of New York conducts kinship proceedings to distribute estates of people dying without close relatives fairly. The state will appoint guardian ad litem to represent undetermined and hard to find relatives who may benefit from the estate.[3] The guardian is responsible to diligently locate any relatives who may be entitled to the inheritance.

What if the guardian knows of a potential relative but does not know their whereabouts? In such cases, there are a few presumptions courts use.

- If three years have passed since anyone heard from that person and a diligent search has been made, the presumption is that they are dead.[4]

- Three years is also adequate if no one hears from them since the decedent’s passing.[5]

- Another presumption is if a relative would be 100 years old, then they are presumed deceased.[6]

As a distant relative, you will have the burden of establishing proof of kinship and proving lineage to the court in a kinship proceeding.[7]

This proof requires considerable evidence gathering and could include:

- witnesses

- family heirlooms

- pictures

- DNA results

- cencus records

- internet database entries

- and other proof

Kinship for Paternal and Maternal Relatives

The case of in re Judicial Settlement of Accounts of Mosey sets a nice example.[8] In Mosey, a person died intestate, with no close family, holding a net estate of approximately $265,000.[9] At the kinship proceedings, nine paternal cousins and two maternal cousins claimed a part of the estate. Two witnesses testified for the maternal claimants and three for the paternal side. The maternal side sufficiently proved through presumptions and via disinterested witness testimony that they are indeed first cousins, the closest kin—and the judge awarded them half of the estate.[10] On the parental side, the judge found that a similar burden of proof has been met to prove they are cousins. However, here, the judge found their evidence “to close the classes of paternal aunts, uncles and cousins is inadequate and does not sustain their burden . . . “. The judge refused to give over half the estate to the paternal side, arguing that the potential for closer relatives freezes the said distribution. The judge distributed half the estate to the two maternal cousins and half to the state for safe keeping.[11] It is unclear what happened next. It could be that the paternal cousins waited out the three-year presumption period and petitioned the court again or that a relative with closer consanguinity appeared to snag the inheritance. But in this situation, it is at least fortunate that relatives benefit. What happens when not even cousins can lay claim on the estate? The estate escheats and the property goes to New York State.[12]

Kinship proceedings can be unpredictable. It also could set maternal and paternal relatives against each other in a battle of the estate. This kinship article should serve as a cautionary tale for people with assets -you should make a will. Additionally, if you are a relative of the deceased who died intestate, do not go into this alone, hire a lawyer.

If you want to know how to establish proof of kinship in New York, a competent New York attorney can help you lay the proper foundation as a beneficiary in a kinship proceeding.

New York kinship laws are complicated, and experience in the Surrogate’s Court practice is paramount when dealing with those issues. Contact attorney Albert Goodwin, Esq., who has more than a decade of experience in kinship and cousin cases. You can reach him at (212) 233-1233.

[1] N.Y. Est. Powers & Trusts Law § 4-1.1

[3] N.Y. Surr. Ct. Proc. Act Law § 403 (McKinney 2018).

[6] In re Judicial Settlement of Accounts of Mosey, 880 N.Y.S.2d 225 (Sur. 2008).

[7] SeeMatter of Whelan, 461 N.Y.S.2d 398, 399 (1983), aff’d, 62 N.Y.2d 657 (1984).

[8] In re Mosey, 880 N.Y.S.2d 225.

[9] Id.

[10] Id.

[11] Id.

[12] N.Y. Aband. Prop. Law § 200 (McKinney 2018).