Can Cousins Inherit Under an Intestacy in New York City

Cousins can only inherit under an intestacy if the person who died did not have a living wife, children, parents, siblings, nieces or nephews, and aunts/uncles. And they may have to share the inheritance with their siblings or other cousins. They would have to go through the kinship process. The amount each cousin inherits depends on how many other living cousins the decedent (person who died) had at the time of his death.

When the only living relatives of a person who died are cousins, they are not allowed to serve as the Administrator of the decedent’s estate. Instead, the Public Administrator of the county where the decedent lived becomes the Administrator of the estate. As such, the Public Administrator has to figure out who the deceased person’s closest relatives are. Typically, each cousin’s estate lawyer would present a case as to how their client is related to the decedent and what percentage of the inheritance that attorneys’ client should receive.

If you would like a consultation about cousins inheriting under an intestacy, you can send us an email at [email protected] or call us at 212-233-1233.

The Kinship Proceeding

The Surrogate’s court uses a kinship proceeding to determine the heirs of a person who died without a wife, children, siblings, parents aunts or uncles. Such heirs are typically cousins.

Your attorney will gather evidence to prove that you are the niece, nephew or cousin of the person who died, and will put together a family tree affidavit supported by evidence of your relationship. The kinship proceeding and will culminate in a hearing where the court referee determines the relatives who will receive the inheritance. After the hearing, the judge will sign off on the report and the person who manages the estate will be able to distribute to you your rightful inheritance from your aunt, uncle or cousin.

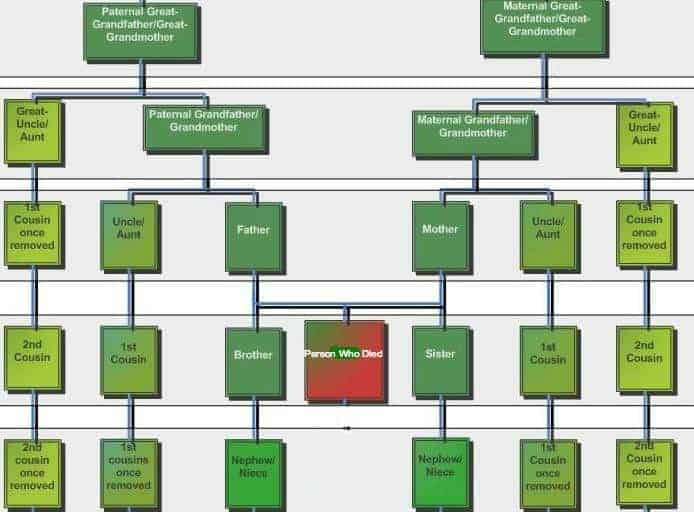

The Family Tree

To prove your relationship to the court, your attorney will make a family tree diagram. It is a chart of the relatives of the person who died, beginning with your closest common ancestor and including all the people who stand to inherit. It looks like a tree because relatives branch out from the common ancestor.

Closest Common Ancestor

If the person who died is your uncle or first cousin, the family tree will start with your grandfather or great-grandmother, depending whose side the uncle or cousin is from. If the person who died is your great uncle or second cousin, the family tree will start with your great-grandfather or great-grandmother.

The family tree must include information such as the relatives’ names, relationships to the decedent, dates of birth, and dates of death. Non-marital children are included. The family tree affidavit must be signed by a non-inheriting person familiar with the relationships. Sometimes that’s the attorney, sometimes the genealogist. Each entry in the family tree should have a supporting record. Each record should be numbered and referred to as “exhibit”. Birth certificates, death certificates, court records and social security records are the best, as they are direct evidence. For lack of direct evidence, circumstantial evidence such as census records, immigration records, work records, personal family records can also be accepted under the right circumstances.

Non-Marital Children

Non-marital children can be found through birth and death records. In cases where paternity is not documented or is disputed, the court will require an evidentiary hearing as to the paternity of the non-marital children involved in the family tree. The person interested in the non-marital children being in the family tree will have to show that the children have been “openly and notoriously acknowledged” by their alleged father. In a few cases, a post-mortem DNA test may be ordered by the court.

Presumption of Death of Some Relatives

If a person has not been heard of three years from the death of the person whose estate this is, that person is presumed to have died before the person whose estate this is.[1]

Excluding Prior Classes

This process of proving to the court that you actually are a cousin is called a kinship proceeding. In this proceeding, a cousin proves that he is the closest living relative by proving to the court that the decedent’s other relatives died before him. As such, the cousin would have to prove that the decedent’s mother and father died before him, that he was not married or was divorced, that he did not have children or that they died before him and did not have children of their own, that his aunts and uncles died before him, etc. In other words, in order for cousins to inherit, they would have to prove that other relatives never existed or don’t exist anymore, and proving the non-existence of something can be a challenge.

To prove that they are the rightful heirs, the cousins would have to provide the court with documents and testimony. Documents such as death certificates and birth certificates, burial records, Ellis Island records, census records and obituaries are common. Testimony of the cousins themselves and the people who knew the decedent are also useful. The court places a bigger weight on documents than on testimony.

First Cousins Once Removed

Children of first cousins are known as first cousins once removed, since they are a generation younger since the first cousins. They are the grand-grandchildren of the decedent’s grandparents. SCPA 4-1.1 First cousins once removed inherit only in limited circumstances – where the decedent does not have regular first cousins on either side (mother’s side or father’s side). Matter of Shumavon, 260 A.D.2d 140.

The Kinship Hearing

The kinship hearing is like a trial because many of the rules of evidence apply, but it is called a hearing because it’s not completely a trial and takes place before a court attorney-referee, not the judge. A kinship hearing can be over in a day, or it may be broken up into several hearings that take place over a stretch of a few months, with adjournments given as the court determines that more evidence is needed.

At the kinship hearing, your estate attorney will present evidence that you are an heir under intestate succession laws of the State of New York. The evidence presented must comply with New York rules of evidence, including laying the foundation, certification, hearsay rules, and the dead man’s statute.

Dead Man’s Statute

You will not be able to testify as to the content of your conversation with the person who died. This is because of an evidence rule called “the dead man’s statute.” [2] But you will be allowed to testify about your own family relations.

The People Involved in Cousin Cases

Court Attorney-Referee

A kinship proceeding is usually not decided by a judge directly, but on a recommendation from a court attorney-referee.[3] You will see the judge in the beginning of the case when the court attorney is assigned, and you will see the judge’s signature at the end of the case when the court attorney’s report is confirmed, but throughout the case, you will be interfacing with the court attorney, who will conduct all of the pretrial conferences [4] and will be the person who will conduct the kinship hearings.

Attorney for Public Administrator

The public administrator manages estates of people who did not make a will and whose relatives cannot be found.[5] The public administrator is a public official, but they do not appear in person at each hearing. Rather, they send a private law firm to appear on their behalf. By the time a kinship hearing happens, the public administrator has probably already been appointed to manage the estate, and is probably in the later stages of finding and collecting the property of the person who died for distribution to the heirs.

If your aunt or uncle died without a will, you can ask the court to appoint you to manage their estate. If your cousin died, then you will not be able to manage their estate. Instead, the court will appoint the public administrator to be the administrator of the estate.[6]

Guardian ad Litem

A guardian ad litem is lawyer appointed by the court for a particular court proceeding to represent people who cannot represent themselves is called a guardian ad litem. In a kinship hearing, the court will appoint a guardian ad litem to represent heirs who are not known to the court. [7] When your New York estate attorney is working on a family tree to prove how you are related to the person who died, the guardian ad litem will be working to find his “clients” – people who are unknown. You and your attorney can help the guardian ad litem find the unknown heirs, or can convince the guardian ad litem and the court that no unknown heirs exist.

Unknown Heirs

Unknown heirs do not appear in the proceeding while they are unknown. They are searched for by the guardian ad litem, and are also sometimes found by you or your attorney, in which event you have a duty to disclose this information to the guardian ad litem. If any heirs are found, they can appear in the proceeding and become known heirs. If there is a suspicion that there are heirs but they cannot be located, then the public administrator will be required to deposit their share of the estate with the comptroller of the county for safekeeping, [8] which the heirs can claim when they are found or when they find their share through an unclaimed property search (or the money may end up staying with the comptroller forever).

Known Heirs

Your relative may have more nieces, nephews or cousins. If that’s the case, then you will have to share the inheritance with the other heirs in your “class,” meaning the other heirs with the same degree of relationship to the person who died.

Genealogist

A genealogist is not required, but can be a big asset to your cases, especially when substantial funds are involved. A good genealogist will help your attorney create a family tree and find all of the available records to prove the relationships. They will testify for you at the kinship hearing.

If the court is not satisfied with the proof that the alleged cousins bring, the court would not authorize the Public Administrator to disburse the funds, instead directing the Public Administrator to deposit the funds with the Department of Finance until the kinship issues are decided. This could be a frustrating process for the cousins, that is why you need the best possible estate attorney you can get if you are a cousin who wants to inherit under intestacy.

Contact attorney Albert Goodwin, Esq., who has more than a decade of experience in kinship and cousin cases. We at the Law Offices of Albert Goodwin are here for you. We have offices in New York City, Brooklyn, NY and Queens, NY. You can call us at 212-233-1233 or send us an email at [email protected].