What Happens if You Get Caught Lying to Medicaid in New York City

Here is a summary of what can happen if you get caught lying to Medicaid in New York City:

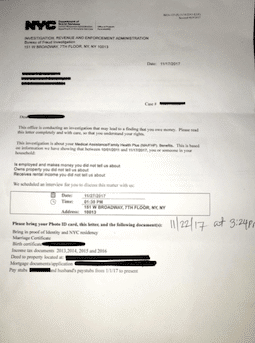

- You will get an investigation letter from the DSS Bureau of Fraud Investigation

- You will have to pay back the money you’ve received from the DSS

- You can go to jail for up to seven years

- You can have a fraud felony on your record

- You can be disqualified from ever receiving Medicaid again

- You will lose your Medicaid benefits

If you are caught lying to Medicaid, the most important thing to do is to not panic and not call the investigator. Instead, it makes sense to discuss the situation with an attorney. The consultation is free.

If you would like to discuss the letter with me personally, feel free to call me anytime at 212-233-1233. I am a private attorney. I don’t work for the government. Everything you say to me is confidential by law.

As a Medicaid fraud lawyer in New York City, I’ve helped many families out of difficult situations. My clients are typically accused of not reporting income or not reporting the man of the household on their application and recertification for welfare benefits. If you think you may be in that kind of situation, and you are being contacted by the Bureau of Fraud Investigation, then you may benefit from information I present in this article.

You Will Likely be Investigated

New York HRA DSS Bureau of Fraud Investigations catches up with people eventually. If you are caught lying to Medicaid about your income, you are likely to receive a letter asking you to meet with the investigators. If you get a letter from the investigator, speak to a Medicaid/SNAP fraud attorney right away.

In Some Cases, You Can go to Jail

Lying to Medicaid can be considered insurance fraud. A person is guilty of insurance fraud in the third degree when he commits a fraudulent insurance act and thereby wrongfully takes, obtains or withholds property with a value in excess of three thousand dollars. Insurance fraud in the third degree is a class D felony. [1]

Getting caught can mean going to jail for up to seven years. For a class D felony, the maximum prison term shall be fixed by the court, and shall not exceed seven years; [2] The minimum period shall be fixed by the court and specified in the sentence and shall be not less than one year nor more than one-third of the maximum term imposed. [3]

Many people who get caught lying to Medicaid have extenuating circumstances. Some people did not understand the Medicaid application. Some people were told by insurance agents that it’s ok to fill out the application that way. Some people thought that for whatever reason, they don’t have to list their husband and his Medicaid application. This is something that a judge may or may not consider to be extenuating circumstances in applying the “nature and circumstances” clause to impose a sentence that is less than one year.

If the court, having regard to the nature and circumstances of the crime and to the history and character of the defendant, is of the opinion that a sentence of imprisonment is necessary but that it would be unduly harsh, the court may impose a definite sentence of imprisonment and fix a term of one year or less. [4]

What is the penalty for Medicaid or SNAP fraud? New York Penal Law 155 describes the sentencing guidelines for someone committing Medicaid or SNAP fraud. The sentence depends on the total amount received. For most people, the amount received from Medicaid or SNAP is between over $3,000 and under $50,000, which according to the guidelines can carry a sentence of up to seven years in jail.

| Amount Received | Degre of Welfare Fraud | Section of Penal Code | Felony Class | Penalty |

|---|---|---|---|---|

| In excess of $1,000 but not more than $3,000 | Fourth Degree | PL 158.10 | Class E Felony | up to 4 years in prison |

| In excess of $3,000 but not greater than $50,000 | Third Degree | PL 158.15 | Class D Felony | up to 7 years in prison |

| In excess of $50,000 but is not more than $1 million | Second Degree | PL 158.20 | Class C Felony | up to 15 years in prison |

| In excess of $1 million | First Degree | PL 158.25 | Class B Felony | up to 25 years in prison |

Restitution. If you are prosecuted by the District Attorney’s office and get sentenced, then you will not only have to go to jail but would also have to pay back the benefits received as restitution.

You Can End Up with a Fraud Felony on Your Record

One of the things that can happen when you get caught lying to Medicaid is you can have a permanent record of a fraud felony. This can be a substantial problem in obtaining employment and maintaining or receiving a professional license. Most companies would not want to hire a person who has been convicted of fraud.

You Will Lose Your Medicaid Benefits

It should come as no surprise that they will cut off your benefits as soon as you get caught lying to Medicaid since you did not qualify for the benefits in the first place.

You can be Disqualified from Medicaid for Life

There could come a time in your life when you would genuinely need Medicaid and will qualify for it. But because of your record of lying to Medicaid, they may have a permanent disqualification on your record, meaning that you will be barred for life from receiving Medicaid for life.

Medicaid Can Sue You to get their Money Back

Not only can Medicaid refer your case to the District Attorney’s office to file criminal charges, but they can also sue you and obtain a judgment against you. Once Medicaid obtains the judgment, they can use it to garnish your paycheck, garnish your bank account, seize your assets such as vehicles and real estate and seize your tax refunds. They will use the power of the government and the courts to recoup the money they’ve spent on your insurance premium payments before you got caught lying to Medicaid.

What do I Do if I Got Caught Lying to Medicaid?

The first step you should take is this: speak with an experienced Medicaid fraud attorney. Do not take the chance of meeting with the investigators on your own. They are trained to obtain information against you that they can later use to their advantage in criminal prosecution and in civil court.

We at the Law Offices of Albert Goodwin are here for you. We have offices in New York City, Brooklyn, NY and Queens, NY. You can call us at 212-233-1233 or send us an email at [email protected].

[1] New York Penal Code 176-20

[2]New York Penal Code 70 (2)(e).