New York Probate Lawyer Fee Schedule: Hourly, Contingency, Flat-Rate

Although there is no mandatory New York probate lawyer fee schedule, here is what a probate lawyer in New York would typically charge:

- For most cases, probate lawyers in New York charge by the hour, at an average of $400 per hour.

- For a few types of smaller cases, probate lawyers can charge a flat fee starting at about $3,000.

- For cases that have a potentially promising outcome but risk not having a recovery at all, a probate lawyer can charge on a contingency basis based on the value of the estate recovery. The rate is usually 33%.

Are you looking for something like a New York probate lawyer fee schedule? Are you wondering how much does a letter of testamentary cost? We will explain how New York probate lawyer fees are calculated and what factors are involved in setting the fees. This information is based on our own experience and on asking other estate lawyers in the New York City area.

Most Cases – $400 per hour

| For most cases, probate lawyer fees are calculated by the hour. The average rate is about $400 an hour, and it varies by the lawyer’s expertise and reputation. Lawyers typically require a retainer deposit of about $4,000 to get started. |  |

To better understand a possible probate lawyer fee schedule, here’s a billable hours calculator. You can plug in the number of hours and minutes and the hourly rate and see how much the total bill would be for that billing period.

[CP_CALCULATED_FIELDS id=”9″]

You can see how the total goes up or down as you plug in different values for the hourly rate.

Some Cases – about 5% of the estate

| For some straight-forward cases, probate lawyer fees are calculated as a flat fee of about 5% of the estate. |  |

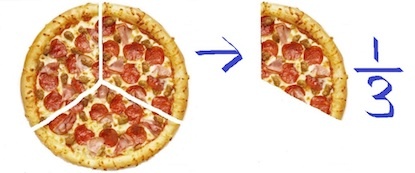

Few Cases – 1/3 of the estate, nothing if no recovery

| For a very limited number of cases, a probate lawyer can agree to work on a contingency fee, of typically contingency 1/3 of the recovery, where the lawyer gets nothing if there is no recovery. |  |

Let us start off with examples of fees set by actual New York estate law firms…

We’ve conducted a survey among New York estate lawyers to see how their firms set their fees. Without listing their names, the table below is a sample schedule of what we’ve found:

| Law Firm | Rate Quoted Over the Phone |

|---|---|

| Law Firm 1: | $400/hr |

| Law Firm 2: | Flat fee depending on the size of the estate |

| Law Firm 3: | 5% of the estate |

| Law Firm 4: | $10,000, + $450 per hour if the estate is contested |

| Law Firm 5: | Depending on the size of the estate |

We’ve had a potential client recently call and he told us that he’s done extensive shopping around, calling different attorneys for his potential will contest case. We asked him what the prices are, and he said that the hourly fees range from $350 to $500 per hour, and the retainer agreements range from $1,000 to $4,000. Seems a little low to us, and he might have been trying to low-ball our firm, as his quote is about lower than the answers we got when we conducted our own survey.

As you can see, there’s quite a range of amounts and arrangements. But it basically comes down to hourly or flat fee, or a combination thereof, as opposed to a probate lawyer fee schedule.

The Three Main Types of Fee Arrangements: Hourly, Flat and Contingency

We’ll explain

- what the basic types of probate lawyer fee arrangements are

- what type of case they apply to

- what type of client fits what type of fee arrangement

- what are the advantages to a client and

- what are the advantages to the lawyer

Hourly Fees – Average $400 Per Hour

|

The hourly fee is the most straightforward way of calculating lawyers’ fees. The lawyer sets the fee they charge for each hour of work and then bills you for the work performed based on how much time it took. |

|---|

The hourly fee can be applied to any kind of case. Fees in the New York market start according to each probate lawyer’s fee schedule, at around $300 per hour and can go up to around $850 per hour.

Here is a sample of our own itemized legal billing statement:

| Date | Time Spent | Task |

|---|---|---|

| 7/3/17 | 0:08 | Review PA’s petition for temporary administration and client’s application for preliminary letters |

| 7/3/17 | 0:25 | review and organize notes, review documents in the case, strategy |

| 7/3/17 | 0:07 | review client’s application in guardianship case to not have ITF accounts disbursed to the PA |

| 7/3/17 | 0:06 | read the letter from the bank lawyer re. distribution of ITF accounts |

| 7/3/17 | 0:05 | skim files emailed by client |

| 7/3/17 | 0:25 | Probate lawyer fees for reviewing client’s deposition transcript |

| 7/4/17 | 0:03 | Read client’s email, edit and re-send consent to change lawyer |

| 7/8/17 | 0:06 | Review consent to change lawyer received from the client, draft authorization to appear, email to client for notarization. Read the New York probate lawyer fee schedule. |

| 7/10/17 | 0:04 | Probate lawyer fees for emailing opposing counsel re. consent to change lawyer |

| 7/10/17 | 1:14 | Conference with client re. tomorrow’s court conference, case strategy |

The advantage of the billable hour structure to the client is that the probate lawyer fee is limited by the number of hours a lawyer works. Clients save money because an hourly probate lawyer fee is typically less than what a lawyer would charge as a flat fee. To make clients more comfortable and take away some of the perceived unpredictability, we sometimes estimate what the cost will be per month. For example, we say that this case will cost you about $1,000 per month for the next six months.

Most estate cases can be handled by a solo practitioner, which results in more savings. When you hire a solo practitioner, they are limited to how much they can bill. There are only so many hours in a day, and we juggle a lot of cases. A client would have to be more careful with a bigger firm. It’s easier for a big firm to charge more money on an hourly billed case. They can charge for associates, paralegals and partners. Sometimes simultaneously in a probate lawyer fee schedule, if they’re all in one meeting on the same case.

Flat Fee: a Set Amount

|

A flat fee is a way to bill for a straightforward probate or administration case. A fee can be set as a percentage of a case or as a set amount, which is the same idea. For example, 5% or $30,000. |

|---|

Flat fees are only available when there are no missing or unknown heirs to find and notify and no other complicating issues.

Flat fees for a New York probate lawyer are out of the question for an estate case involving litigation or will contest. It’s up to the client how far they take a case. Paying a flat fee can give the client a cost incentive to “get their money’s worth.” The client may want to push the case as far as they can, which can result in an excessive amount of work for the lawyer. Ultimately, a flat fee in a contested litigation case can result in disappointment to the client. It’s often better to settle while you have the chance as opposed to pushing the case to an unpredictable trial.

Flat fee schedules are rare. As a safety measure, most flat fee retainer agreements include a caveat that if there’s litigation not listed in the agreement, then the lawyer adds an hourly fee. There can also be an option to add to the flat fee after a certain amount of hours. Or, switch to an hourly fee and convert the flat fee to a retainer deposit. A lawyer should explain to the client exactly what is and what is not included in the flat fee.

Based on our understanding of the professional conduct rules, it’s possible that taking a flat fee upfront or creating a probate lawyer flat fee schedule could present an issue for the lawyer when the fee is of any significant size. Instead, it’s probably better to take the fee at the end of the case or gradually as the lawyer is performing the work. A lawyer charging a flat fee should be mindful of non-refundable retainer rules.

For a probate lawyer charging a flat fee, it’s important to keep a log of the time they put in and the tasks they perform. This log should be similar to one the lawyer would have maintained if the billing structure would have been hourly. This way, the probate lawyer can demonstrate work performed and justify their fee. Keeping a long also minimizes a chance of a fee reduction if there is ever a billing issue with the client or the estate’s beneficiaries.

Contingency Fee: Percentage of Recovery, $0 if No Win

|

A contingency fee is deducted from the recovery the lawyer gets for the client. The amount the contingency fee is usually 1/3 of the recovery, plus expenses such as expert fees and court reporters. If the case does not win, the lawyer does not get anything. |

|---|

A contingency fee in an estate case is accepted by the probate lawyer who believes they can get a substantial amount of money for their clients. If the case settles for a small amount, a lawyer still gets a share of the small amount, but they would probably end up losing money.

Experienced estate lawyers will only accept a contingency case if

- the estate is large

- has cash or liquid assets

- the lawyer feels that they can resolve the estate quickly and easily

Lawyers prefer a client who is reasonable and agreeable, for two reasons. First, we want a client who is pleasant to deal with, and more importantly, agreeable to a fair settlement. Second, if a person behaves unpleasantly, then the reason for the decedent leaving them out of the will is self-evident and a reasonable settlement will be hard to get.

A good contingency case with a high chance of success usually involves a client who is a relative who is challenging a bequest to a neighbor, friend or care provider. A client who is challenging a sibling is also a right candidate for a contingency, as siblings often relent and go easy on each other.

Summary of Fee Schedules

| Hourly Fee: | About $400 per hour, a retainer of about $4,000 is typically required |

|---|---|

| Flat Fee: | About 5% of the estate |

| Contingency Fee: | 1/3 of what the lawyer wins |

Comparing the Fee Schedules

Hourly vs. Contingency: The advantage of an hourly case over a contingency case is that the client keeps the entire share of the estate that they are entitled to, paying only hourly probate lawyer fees. Let’s say you’re fighting for a $1 million share of an estate. If you win, it would have been worth it to pay probate lawyer fees in the amount of $50K, as opposed to giving the lawyer 1/3 of the $1 million. But if you lose and get nothing from the case, you would have been better off with a contingency, paying a probate lawyer fee of $0, as opposed to paying them $50K. If you didn’t have $50K in the first place, the contingency arrangement might have been your only option anyway.

Hourly vs. Flat Fee: An hourly case will typically be more cost-effective than a flat fee that is more than $15K. A lawyer who knows what they’re doing is not going to charge a very small (i.e. $5k) contingency fee and accept the chance that something will go south and they will need to perform more work. At a minimum, the lawyer will have a clause in the retainer agreement that any extra work will be charged by the hour, which is not a real flat fee.

Advantages and Disadvantages to Client

| Type of Fee | Advantages to Client | Disadvantages to Client |

|---|---|---|

| Hourly Probate Lawyer Fees | You know how much you’re paying for each hour of lawyers’ work. You get a minute-by-minute statement of how much work is done. | Even though most lawyers are conservative in their billing practices, many clients still have a perception that they have no control over the amount of time and money being spent on their case. |

| Flat Probate Lawyer Fee | You know exactly how much you are paying. | Not offered for contested cases. Uncontested cases may be cheaper if you pay by the hour. |

| Contingency Probate Lawyer Fee | If you lose, you don’t pay anything. | If you do win big, then it would have been much cheaper to pay by the hour. |

Advantages and Disadvantages to Lawyer

| Type of Fee | Advantages to Lawyer | Disadvantages to Lawyer |

|---|---|---|

| Hourly Probate Lawyer Fee | Lawyer gets paid for their time. | In a big case, a contingency win would have netted a bigger fee. |

| Flat Probate Lawyer Fee | The lawyer is guaranteed a set amount. | The lawyer can be in a situation where they would have to perform more work than anticipated |

| Contingency Probate Lawyer Fee | If the client wins big, the lawyer gets to share in the reward | If the case loses, the lawyer gets nothing for their time. |

Hybrid Probate Lawyer Fees

Although less common, hybrid fee arrangements are possible if contracted in writing between the lawyer and the client. The most common on is “flat fee, but hourly if more work is required,” a similar one is “flat fee, but switches to a retainer and hourly if more work is required.” There’s also “reduced hourly with a contingency” or “reduced hourly with a reduced flat.” I suppose there could be “flat with a contingency.”

Make sure the lawyer follows the professional rules when it comes to charging a flat fee or a hybrid fee involving a flat portion and is careful to comply with non-refundable retainer rules.

When is a Retainer Required

Probate Lawyers don’t require an upfront payment when the client is an executor, administrator or trustee, because they are about to get access to the estate or trust funds. Because the executor does not have access to the estate’s funds at the initial stage of the proceeding, it would not be reasonable to ask them for a retainer. Lawyers do not want to create a “Catch-22” situation in which the executor can’t get the money to get to the money. When representing an executor, lawyers bill the estate for work performed and get paid by the executor from the estate.

Lawyers only give the executor this break if the estate has cash or liquid assets. In an estate that cannot pay the lawyer even after the executor is appointed, then a lawyer requires a retainer upfront.

Most lawyers require a retainer deposit when the client is suing the estate. A lawyer would require a retainer for a will contest or to allege that assets are missing from the estate. By law, the beneficiary does not have access to the estate’s funds until the executor distributes the funds. Executors know this and tend to hold out distributions until they are either forced by the court or the beneficiaries sign a release. For this reason, lawyers require a retainer before they take on estate litigation on behalf of a beneficiary. Unless it’s a contingency fee arrangement, in which case the lawyer is risking being paid nothing if the case does not win.

Excessive Fees are Not Allowed, But Large Probate Lawyer Fees are Allowed

New York Rules of Professional Conduct preclude lawyers from charging fees that are excessive and define what “excessive” means.

Probate lawyers are not allowed to rip the clients off. However, that does not mean that lawyers cannot charge significant fees.

In an hourly case, a lawyer can end up charging a significant total fee as long as

- the fee is justified by the amount of work performed

- the lawyer keeps a record of the hours spent and

- timely provides the client with an itemized statement.

In a contingency case, a lawyer can charge a substantial fee as long as the case was reasonably difficult to win.

New York has a complicated body of statutes and cases dealing with lawyers’ fees. The basics can be found in the Rules of Professional Conduct.

Capped Fees: the Fee Schedule that Never Happens with Estate Lawyers

Law firms don’t accept “capped fee” arrangements, where they work for an hourly fee but the total amount billed is capped at a certain number. For example, you can bill by the hour, but the total cannot be more than $30,000. A capped fee would give a client a strong incentive to push a case further than it needs to be pushed and to decline a reasonable settlement, to their detriment. It also gives a law firm an incentive to limit their work, which is not always great for the client. A capped fee arrangement skewers the incentive system and is detrimental to both the lawyer and the client.

Paying Less Can Mean Paying More

Let’s say you hire a probate lawyer who charges $250 per hour but has not done a case like yours in the past. This lawyer can easily spend ten hours just figuring out what to do in the case. A lawyer who charges a little more already knows how to do and can do in an hour. Not to mention, a lawyer with more experience may have more knowledge of what can win this type of case. So paying less hourly for a lawyer is often not a bargain.

Experience and Reputation Matter

When looking at a possible lawyer fee schedule, what a lawyer can do for a client is even more important than the numbers game of the estate lawyer’s fee. For a client who wants a good result, the experience and skills of a top estate lawyer are well worth a premium in lawyer fees.

It is also essential that the client is comfortable that the lawyer is on the same wavelength as them, that they can establish excellent communication and rapport. The lawyer-client relationship can be just as important as the lawyers’ expertise, as the lawyer is ultimately a messenger for the client’s version of the truth in the case.

As you can see, the total price of a lawyer varies from law firm to law firm and case to case. It is often impossible to predict what the total fee would be. Comparing your case to the way lawyers usually bill for similar cases can help you estimate the amount of money you’ll spend on a probate lawyer.

We hope that this summary has been helpful. If you’d like to get our fee schedule, you’re welcome to give us a call at (212) 233-1233.