Responding to a Letter from the HRA about SNAP or Medicaid

If you just received a New York Medicaid investigation letter or SNAP investigation letter from the New York City HRA fraud investigation department, the most important thing to do is to not panic and not call the phone number on the letter. Instead, it makes sense to discuss the situation with an attorney. The consultation is free.

I am a food stamp fraud and medicaid fraud attorney. If you would like to discuss the letter with me personally, feel free to call me anytime at 212-233-1233. I am a private attorney. I don’t work for the government. Everything you say to me is confidential by law.

I understand that you have a lot of questions. So here are the questions that people ask me all the time when they discuss their food stamp fraud cases, and my answers, based on my experience dealing with food stamp fraud investigations.

Should I contact the investigator like the letter says?

It is probably best not to contact the investigator. They are trained to get you to provide incriminating information that can be used against you in court. If you talk to the investigator, they will ask to provide more information and will ask to provide documents. They will continue working the case until they build enough of a case to take to court and secure a criminal conviction.

Recently, they have also set up an online portal where they ask the targets of their investigation to send them documents. After that, if they receive enough incriminating information about their target, they may refer the case to the District Attorney’s office to prosecute in criminal court.

They may ultimately settle the case with no criminal liability. But they like to build a strong criminal case against you first. Which is something that you would rather do without.

And this is why speaking to an investigator is a bad idea. Because you will end up providing incriminating evidence against yourself.

If I just ignore the letters, will the case go away?

Ignoring the investigation is a bad idea, because it will not go away on its own, it will only get escalated to the District Attorney’s Office. That’s because even though they don’t have your testimony, they typically already have enough documentary evidence to build a successful criminal case against you.

This is why the best way to resolve a food stamp investigation is to have an attorney handle it for you. Attorneys are trained to protect your rights.

If you need an attorney, we at the Law Offices of Albert Goodwin are here for you. You can call us right away at 212-233-1233.

Should I tell the investigator that I’m in the process of hiring an attorney?

If an HRA investigator sees that you are not following up, they may try to contact you. You can just tell them that you cannot talk to them. There is no need to worry about disappointing the investigator. They understand that remaining silent is your right and that letting you remain silent is a part of their job.

It’s definitely not a good idea to back to them. Then you are just doing their job for them. Have an attorney follow up with them instead.

I don’t think I need a lawyer. Can I just outsmart the investigator?

An investigator has years of training and experience that you do not have. They have many strategies at their disposal. Here are some examples:

- They can pretend to be friendly

- They can lie to you

- They can threaten you

- They will try to get you to reveal incriminating information that can be used against you by the D.A.

- They can detain you

- They can show their true face and let you know what kind of trouble you’re really in

- They can work in pairs and play good cop-bad cop

- They can make you sign a statement

- They will record everything you say

- They can testify to what you’ve said

- They have the time to be persistent

And what strategies do you have? None.

- Do not talk to the investigator

- Do not be friendly with them

- Do not cry

- Do not give them excuses

- Do not try to show them that you’re a real person, not a criminal from TV

- Do not think that if you’re honest and provide all the (incriminating) information, they will let you go

- Do not tell them you’re a single mom

- Do not beg for their sympathy

- Do not tell them you don’t have money

- Do not tell them you didn’t know

- Do not tell them the children’s father and you are “separated” in your mind

- Do not tell them someone else told you to fill out the application this way

- Do not tell them you don’t know the language

- Do not tell them the change is recent and you didn’t have the time to report it

- Do not them you had no choice

- Do not tell them it’s the government’s fault

If you continue talking to the investigators, you will crack under the pressure. Everyone does.

I already talked to the investigator. Am I in big trouble?

If you did already talked to the investigator, it’s not the end of the world, and there is no need to despair. But speak to a food stamp fraud attorney as soon as you can, to have the best strategy to remedy the situation.

What kind of evidence do they already have against me?

Here is the kind of evidence the investigator already has:

- Records of everyone who resides in your household

- Records of everyone’s income, from tax returns and employment records

- Records of everyone’s assets, from bank statements and deeds

- Copies of leases

- DMV records

- Records of everyone’s addresses and actual physical place or residence and employment

- Records of usage of the benefits card, including date, time and location

- Photos, videos and recordings

Will I go to jail?

Some people have gone to jail for Medicaid or SNAP fraud. But that does not mean that you will. What this does mean is that you should speak to an attorney immediately and discuss your legal strategy. Since Medicaid and SNAP fraud is a crime, HRA investigations can be escalated and referred to the District Attorney’s office by the HRA’s investigator. It is crucial to hire a fraud defense attorney who is familiar with criminal investigations, in order to increase your chances of a good defense.

What is the penalty for Medicaid or food stamp fraud?

New York Penal Law 155 describes the sentencing guidelines for someone committing Medicaid or SNAP fraud. The sentence depends on the total amount received. For most people, the amount received from Medicaid or SNAP is between over $3,000 and under $50,000, which according to the guidelines can carry a sentence of up to seven years in jail.

| Amount Received | Degre of Welfare Fraud | Section of Penal Code | Felony Class | Penalty |

|---|---|---|---|---|

| In excess of $1,000 but not more than $3,000 | Fourth Degree | PL 158.10 | Class E Felony | up to 4 years in prison |

| In excess of $3,000 but not greater than $50,000 | Third Degree | PL 158.15 | Class D Felony | up to 7 years in prison |

| In excess of $50,000 but is not more than $1 million | Second Degree | PL 158.20 | Class C Felony | up to 15 years in prison |

If you are prosecuted by the District Attorney’s office and get sentenced, then you will not only have to go to jail but would also have to pay back the benefits received as restitution.

Do I have to pay back the benefits?

The important thing to remember is that the priority is to avoid criminal liability. Having said that, the amount of payback is also important. In some cases, especially when the total amount is very high, and the beneficiary’s eligibility is questionable but plausible, reducing the amount owed for money expended by the Department of Social Services for food stamp benefits may be possible. Some of the ways we do that are showing a period of eligibility. The food stamp investigator letter can be an indication of what we are dealing with.

If we can prove to the Department of Social Services that you were eligible in the first place, then it may be possible to avoid benefit payback, and it may be possible to keep your services and benefits. However, most investigated cases have a solid foundation and are difficult to challenge in a significant way.

Can I pay back in installments?

The investigation department’s priority is to collect as much as they can with as much of it upfront as possible. It is possible in some cases to enter into an installment agreement, with assistance from an experienced food stamp fraud lawyer.

How much does it cost to hire an attorney?

The fee for a Medicaid fraud or food-stamp fraud attorney to represent you during a Medicaid or SNAP food stamp investigation by the DSS/HRA would depend on your situation.

Can I get reapply for benefits later?

You can go to your local food stamp office and reapply if you have just become eligible, even if you were not eligible before.

If a person does not reside in the household, can the department investigation still say that they do?

Even if you claim that a person does not reside in the household, the Human Resource Administration Bureau of Fraud Investigation administration can still consider them to be a part of the household and target them as a part of the Medicaid and SNAP investigation process. We often see a person not listed as part of the household receiving a letter from the bureau of fraud investigation as well. A children’s father is considered to be a part of the household often just by virtue of being the father, and often with the following additional factors:

If your letter is specifically about household composition and not reporting someone in your household, read more about SNAP household composition fraud investigations.

- spends time in the household

- married to the mother of the children

- list the household address on his tax returns

- claim children as dependents

- claims the mother of the children as a dependent

- has his name on the deed, lease or the utility bills

- provides material support for the family

We’re separated living together?

We live together, but I am of the opinion that we form separate households, we are two different families, why is the Department of Social Services saying that we are in one household?

The DSS/HRA in New York views everyone living in the household as being the same household, even if the people themselves don’t consider themselves that way. The Medicaid administration would be especially concerned if the people in the house are related – let’s say, grandmother or uncle. It’s different if people are just roommates. In a situation where there is a family, especially where the father of the children is not listed on an application or recertification, a fraud investigation is a frequent occurrence.

Is there a way to beat a Medicaid or SNAP fraud investigation? Read about the 9 things we always do in an HRA SNAP or Medicaid fraud investigation plus the 5 things you should never do in a New York City HRA SNAP or Medicaid fraud investigation.

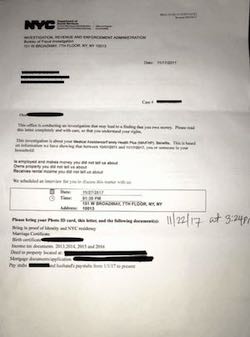

I got a letter from the HRA and it’s unclear. What does it actually say?

Here is the standard text of the letter in its entirety:

NYC Department of Social Services

Human Resources Administration

Office of Program Accountability

INVESTIGATION, REVENUE AND ENFORCEMENT ADMINISTRATION

Bureau of Fraud Investigation

375 Pearl Street, 22nd Floor, NY, NY 10038

Dear Sir or Madam:

This office is conducting an investigation that may lead to a finding that you owe money. Please read this letter completely and with care, so that you understand your rights.

This investigation is about your Supplemental Assistance Program (Snap), Medicaid or Child Health Plus (CHIP) Medical Assistance/Family Health Plus (MA/FHP) Benefits. This is based on information we have showing that you or someone in your household:

Did not report someone in your household

Did not report assets

Did not report income

Is employed and makes money you did not tell us about

Owns property you did not tell us about

Receives rental income you did not tell us about

Did not report the correct residence

Please provide the following documents within 12 business days of the date of this letter:

NY state ID card

Birth certificate

Marriage Certificate

Mortgage documents

School letter

Income tax documents

Pay stubs (last 4 pay stubs)

W2 or 1099

Lease or Deed to property

last six months bank account statements

Title for cars

Utility bills

To submit the documents, send us an email to the investigator’s email address and you with receive an email with a link to upload the documents. You will need to include the control number when completing the on-line form.

Cannot upload your documents to a smartphone or computer? You can mail us copies of the documents using the enclosed return envelope.

If you mail the documents to us, please call the investigator by the following date.

We scheduled an interview for you to discuss this matter with us.

Please bring your Photo ID card, this letter and the documents above.

Bring in proof of Identity and NYC residency

If you need more time to find these documents or need to reschedule the interview, call the investigator.

IMPORTANT NOTICE

You can bring an attorney or another representative to assist you in resolving this matter. You can contact your bar association or a legal services organization to seek free legal representation.

You are entitled to interpretation assistance. Please let us know if you would like us to provide an interpreter in the language that you request.

You may answer questions or choose not to say anything. If you do answer questions, your benefits cannot be stopped or reduced just because you did not answer.

If our investigation finds that you were ineligible for benefits received, we may ask you to repay them. You do not have to sign a repayment agreement. However, if we do not come to an agreement, we may sue you in civil court to get back the amount owed or, in some cases, refer you for criminal prosecution.

If our investigation finds that you were ineligible for benefits received, we will

- contact you to schedule a telephone interview and

- decide the most effective way to resolve this case

This could include:

- you being sued in civil court to recover the amount owed

- referral for a criminal prosecution, or

- a repayment agreement

You may still be eligible for certain benefits now even if you were not eligible in the past. If you would like to discuss your current eligibility for Medicaid or SNAP, you can go to your local Medicaid or SNAP office.

TRAVEL INSTRUCTIONS

(By Train) No. 1 to Franklin Street; A, C, E, to Canal Street; A, E, No.2 & 3 to Chambers St.

Our Office is located at 375 Pearl Street, 22nd Floor.

Do you have a disability or a health condition that makes it hard for you to understand this notice or to do what this notice is asking? Does this condition make it hard for you to get other services at HRA? Call us at 212-331-4640 and we can help you. You can also ask for help when you visit an HRA office. You have a right to ask for this kind of help under the law.

A letter like this can also come from 151 W Broadway, 7th Floor, New York, NY 10013.

If you think that the HRA Medicaid Fraud Division is investigating you for SNAP or Medicaid fraud, contact an attorney immediately.

Albert Goodwin, Esq. is an attorney who helps people who got a letter from the HRA negotiate with the investigators. He also represents clients in defending criminal charges associated with Medicaid and SNAP fraud. You can reach Albert Goodwin, Esq. at 212-233-1233 or by email at [email protected].