How Much Does a Letter of Testamentary Cost?

There are two components of a letter of testamentary cost: the court fee and the attorney’s fees. The court fee ranges from $45 to $1,250, depending on the gross value of the estate. The attorney’s fees start at about $2,500 and can go up depending on the complexity of the case. The typical arrangement in our firm is to offer a flat fee of $2,500 and to charge $400 per hour for any work beyond seven hours. If you would like to consult with us, you can send us an email at [email protected] or call us at 212-233-1233.

Estate Complications That Raise the Cost of a Letter of Testamentary

For an estate with routine complications, it can cost double the amount to get a letter of testamentary. You are looking at upwards of $5,000 because of the additional attorney’s fees. Here are the routine complications you would typically encounter:

- Having to notify many parties. As part of the process of obtaining letters testamentary, we have to notify every party who is benefitting from the will and every relative who is not mentioned in the will. This can be easy if everyone accepts notice and signs off on a waiver. It can get a little harder if someone does not sign the waiver for whatever reason and we have to officially notify them by having a service personally deliver the notice to them. The good news is, if the person lives out of state, we can notify them by certified mail. So having many parties to notify would not necessarily increase how much letters testamentary would cost.

- Difficulties obtaining a bond. A bond is a type of insurance that protects against bad acts of the executor. Typically, the courts don’t require a bond for executors. But if they require it in your case, then it may create an extra step that will cost you extra money, both in bond insurance payments and in extra attorney’s fees for dealing with bond documentation. As an additional bond complication, you can only get this insurance if you have good credit. If you don’t pass the credit check, then you would have to go through the extra step of having your attorney be an administrator and essentially vouch for the safety of the estate. This extra application will increase the procedure involved and consequently will increase how much the letter of testamentary will cost in attorneys’ fees.

- Being a sole heir. When someone is a sole heir, the court can require them to submit an affidavit of heirship and in some cases a family tree affidavit from a disinterested party, which can increase how much a letter of testamentary costs in attorney’s fees. If you do not have a disinterested party who has all the information about your family tree, then you will be required to produce an affidavit from a geneologist. A geneologist can charge upwards of $200 per hour, which, coupled with extra attorney’s fees required to complete the affidavit, would raise how much the letter of testamentary costs.

- A need for the attorney to act as the administrator. If the attorney needs to act as the administrator, they would charge you extra for that service, increasing the cost of the letter of testamentary. An attorney can charge an administrator’s commission, which is determined on a percentage basis.

- Errors on the death certificate. If a death certificate contains an error, then we would have to put together a sworn document explaining the error to the court. This document is called an affidavit, and having to put one together would increase how much attorneys’ fees for letters testamentary will cost.

Serious Complications with an Even Higher Cost

For an estate with serious complications, it can cost tens of thousands of dollars in attorney’s fees to get a letter of testamentary. Like we said before, even if an estate attorney initially offers a flat fee, the flat fee arrangement goes out the window once complications are involved. Here are the major complications that would significantly impact how much a letter of testamentary would cost:

- A will contest. The most expensive and stressful litigation in an estate case is a will contest, where a relative is trying to overturn the will. A will contest places the probate proceeding on a litigation track, and can take a lot of an estate attorney’s time and resources, thereby increasing how much the letter testamentary costs. A will contest will involve an examination under oath of the attorney who drafted the will, the witnesses to the will, the person presenting the will for probate and anyone else with knowledge of the facts. It may involve obtaining and reviewing the decedent’s medical records in order to assess his capacity to make a will. A will contest can quickly turn into a long and involved lawsuit that can cost tens of thousands of dollars and cost years of delay. A will contest can result in having to pay out a settlement, which would also increase the cost of the letter of testamentary.

- A search for parties with an unknown address. As we’ve mentioned before, the court is very particular about officially notifying every party entitled to notice, no matter the difficulty. It typically takes about six months to complete all the required research and publication required to notify parties whose address is unknown. This extra requirement of the attorney’s time increases the cost of the letter of testamentary. You may also have an additional cost of paying a geneologist and a private investigator, who can charge upwards of $200 per hour.

- Kinship claims. Someone can claim to be a child of the decedent or a child of some other relative that is related to the decedent. If a person comes out and claims to be a relative of the person who died, dealing with that claim can add to tens of thousands of dollars in attorney’s fees and settlement costs.

- A search for unknown parties. The courts are very particular about notifying every party who is in any possible way affected by the will, even if they are not even mentioned in the will. Courts often require the executor to show that an effort was made to search for parties even if they are not likely to be found, such as when they are the decedent’s far removed relatives from overseas who may not have even existed. This can take a year or more to resolve. Like we said before, having to locate parties may involve the additional cost of paying a geneologist and a private investigator, increasing the cost of a letter of testamentary.

The extra time and resource requirements of the estates with major complications increase the costs of the letter of testamentary. When you enter into a retainer agreement with the estate attorney representing you in obtaining letters of testamentary, the costs will be a part of the retainer agreement, and it will specify that the costs will increase in the event of complications.

Additional Legal Expenses After You Receive the Letter of Testamentary

Just because you received letters of testamentary, your legal expenses may not stop there. Here are some expenses that would increase the total cost of a letter of testamentary.

- Having to Submit an Accounting. If the beneficiaries of the estate don’t trust your handling of the estate, you would have to submit a judicial accounting, which is a summary of the assets and expenses of the estate.

- Dealing with Creditors. Having to deal with creditors is an additional cost of letters testamentary. The most notorious creditor is Medicaid, which can ask for tens or sometimes even hundreds of thousands of dollars, sometimes even in excess of the value of the estate. Business partners and spouses are other examples of creditors. Negotiating and settling with Medicaid or other creditors is an additional cost.

- Closing out the estate. Most estates are simple to close with simple forms, but where you have beneficiaries who don’t trust the executor, you would need to close out the estate though a judicial process, and that takes more time and costs more in attorney’s fees.

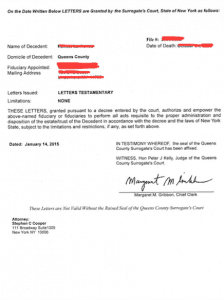

The document is actually called Letters of Testamentary, and it’s not a letter – it’s a court order. The confusion stems from the fact that Order used to be called Letter hundreds of years ago.

This article is meant to give you a bird’s eye view of the factors involved. If you would like to get an estimate of how much does a letter of testamentary cost in your particular case, you can give us a call and we will be happy to provide you with an estimate. We at the Law Offices of Albert Goodwin are here for you. We have offices in New York City, Brooklyn, NY and Queens, NY. You can call us at 212-233-1233 or send us an email at [email protected].