Can an Executor Withhold Money from a Beneficiary? Can they Hold Back, Refuse or Deduct Money?

Can an executor withhold money from a beneficiary? Not indefinitely, but yes for a reasonable period of time.

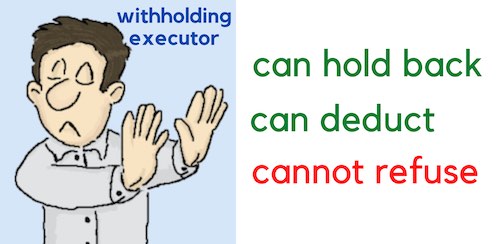

In a dictionary, the word “withhold” can mean three possible things:

- hold back

- refuse

- deduct

So, to completely answer can an executor withhold money from a beneficiary, we would have to go through those three possible meanings. Luckily, this is simple enough.

Here we go:

| Can the executor hold back the money for a period of time? | Yes |

|---|---|

| Can an executor completely refuse to give money to the beneficiary? | No |

| Can the executor deduct certain sums from the money? | Yes |

If you are asking can an executor withhold money from a beneficiary, you likely are looking for a consultation with an attorney. We at the Law Office sof Albert Goodwin are here for you. You can call us at 212-233-1233 or send us an email at [email protected].

The Executor Can Hold Back the Money for a Reasonable Period of Time

Just because you are waiting doesn’t mean that the executor is withholding money – they may be doing other things. The executor can hold the money back for a period of time. Typically, the period of time is about seven months, but it could be longer based on the specific circumstances of the estate.

The Seven-Month Waiting Period

Under most circumstances, a beneficiary does not receive their inheritance right away. There is a waiting period. According to New York law, creditors have seven months to claim what is owed by the estate. This time limitation creates an idea of how long it will take to get your inheritance. It may be that the executor is not withholding money from a beneficiary, he is simply waiting out the required period.

Delays in Marshaling Assets

Before the executor can distribute money, the executor has to find the money first. If the person who died did not leave a detailed list of the assets in the estate, then the executor will have to perform multiple searches:

- Look through the deceased person’s documents

- Find the deceased person’s safe deposit boxes

- Search for real estate

- Search for other assets

As long as the executor is performing their duties, they are not withholding money from a beneficiary, even if they are not yet ready to distribute the assets.

Delays Because of Litigation

If there is litigation involved, then there could be a more extended period going by before you can collect the money from your inheritance. Different types of litigation can affect an estate.

- A pain and suffering claim, possibly related to the circumstances or cause of the death

- A wrongful death claim

- A medical malpractice claim

- A business dispute

- Real estate eviction

- The validity of the will

- The qualification of the executor

Litigation can add years to an estate proceeding and may give an impression that the executor is withholding money from a beneficiary.

The Executor Can Deduct Certain Expenses From the Money

The executor can use money to pay for estate expenses, taxes and attorneys fees – those costs come out of the estate before any money is distributed to the beneficiary.

What to Do if the Executor is Refusing to Distribute Money to a Beneficiary

Once seven months have passed, and the executor is still not releasing money or property left by the estate, then the executor may actually be withholding money from a beneficiary.

While the majority of executors handle probate timely and adequately, there are times where an executor withholds money or property from a beneficiary. There are specific steps that you can take to hurry the executor along and protect your interest in an estate. After all, you are entitled to a full accounting of the estate’s assets and to the timely distribution of the estate’s money and other assets.

A minority of executors go as far as to steal from the estate and mismanage the estate and then attempt to cover up their misdeeds by not communicating with the a beneficiary. There is recourse against an executor who violates his duty to the estate. The recourse involves court intervention. A beneficiary can bring a proceeding to have the judge of the Surrogate’s Court compel the executor to file an account of the estate.

What an Estate Attorney Can Do to Stop the Executor from Withholding Money

The Game Plan

An estate attorney can help you protect your rights and get your money in a timely manner. Here are the steps that we would usually take when the executor withholds money from a beneficiary, in the order of escalation:

- Contact the executor or their attorney and ask them for status and an estimated time of distribution of funds

- Remind the executor that the estate is not a free-for-all, they have to follow rules and make timely accounting of the estate and distribution of funds to the beneficiaries

- Compel an estate accounting through the courts

- Review the accounting and see if the executor is unjustly taking any property for themselves

- Compel a distribution of funds to beneficiaries through the court

- Bring a proceeding to punish the executor for contempt of court

Demand for an Estate Accounting

If we feel that the executor is withholding money, we would first file a petition or an accounting of an estate, to get an idea of what the executor is claiming is left for distribution. If there are disagreements over what is in the estate, we resolve those disagreements before moving on to the distribution stage.

If ordered to submit an accounting, the executor will have to submit the accounting to the court, usually within thirty to sixty days.

An estate accounting is a set of schedules that include all possible information about the estate, such as

- an itemized list of the assets that are in the estate

- the funds or property received by the estate

- the expenses of the estate

- the beneficiary distributions already disbursed and

- the beneficiary distributions yet to be disbursed

A beneficiary and their estate attorney can review the schedules and decide that they are satisfied with the information. Or, they can compel the executor to provide all of the documents associated with the estate as well as the executor’s personal documents. A beneficiary is entitled to documentation, such as

- account statements

- closing statements

- copies of checks

- tax returns

- loan applications

Proceeding to Compel the Executor to Stop Withholding Money

If the accounting is resolved and the executor is still not distributing money to a beneficiary of the estate, we then go to the next step. We would file a petition to compel a distribution, to ask the court to force the executor to stop withholding money from a beneficiary and to release the inheritance. This law is meant to protect beneficiaries from an executor who either is lax in handling their duties or is purposefully refusing to distribute the inheritance. The law lets you ask the court through a New York estate attorney to force the executor to turn over property that you are entitled to.

Proceeding to Punish the Executor for Contempt of Court

If the executor does not comply with the court’s order and still withholds money from the beneficiary, the court can issue an order of contempt, which can include

- taking the executor’s share of the estate

- seizure of the executor’s money and property

- jail time

If you are asking can an executor withhold money from a beneficiary, it is likely that something is going on with the estate. We at the Law Offices of Albert Goodwin are here for you. You can call us at 212-233-1233 or send us an email at [email protected].