How to Get Letters Testamentary

You want to know how to get Letters Testamentary, and we will explain how to do that. But for starters, we would like to clarify something important, to clear up some confusion. Although the document is actually called Letters Testamentary, it’s not a letter. It’s a court order.

This common confusion stems from the fact that “Order” used to be called “Letter” hundreds of years ago and the name stuck in courts to this day, even though regular people have long stopped using the word “letter” this way.

Steps you need to take to obtain a letter of testamentary

Since letters testamentary is an order, you can only get it from a court. Remember, it’s not a letter, so you can’t write it and your lawyer or anyone else can’t write it for you. Your attorney can get this order from the probate court. Although you can file the petition yourself, it might take you longer to receive the letters testamentary because missing one document in your filing can delay the issuance of your letters testamentary for months.

If you are looking for an experienced attorney who can represent you in getting letters testamentary, we at the Law Offices of Albert Goodwin are here for you. You can call us at 212-233-1233 or send us an email at [email protected].

Letters testamentary vs. letters of administration

In order to get this court order, you first need to determine whether you need letters testamentary or letters of administration. If the decedent died with a will, you will need letters testamentary. If the decedent died without a will, you will need letters of administration. This is a substantial distinction because a different petition will be filed with different supporting documents, depending on whether the decedent died with or without a will.

Decedent’s residence

Once you’ve determined that the decedent indeed died with a will, you need to figure out where to file your petition and where to get the letters testamentary. The petition for probate is filed with the county of the Surrogate’s Court where the decedent last resided. It’s important to remember that you file the petition in the county of decedent’s last residence and not where he died.

For example, if your loved one was a resident of New York county, but died in a nursing home in Brooklyn, you file the petition in the Surrogate’s Court of New York County, and not King’s County where Brooklyn is.

What if the decedent stopped renting the apartment in New York county prior to entering the Brooklyn nursing home? Do you still file the petition in New York County Surrogate’s Court? Yes, you still file your petition in New York county because a nursing home is not considered a domicile. Even if the decedent no longer owns or rents the home in New York county, you still file the estate proceeding in the county where they lived before entering the nursing home.

What if decedent lived in New York, but died while visiting family members on a 3-month vacation in Florida? Do you file the petition in Florida? No. You still file the petition in New York, because the estate proceeding has to be filed where the decedent is a resident and not where the decedent died.

What if the decedent lived and died in Florida, but owned a Manhattan apartment? Where do you file your petition? In this case, the principal estate proceeding has to be filed in Florida because this is decedent’s last known residence. However, in order to sell or administer the Manhattan apartment, an ancillary probate petition has to be filed in Manhattan after you receive your letters testamentary from the Florida court.

Documents required to obtain letters testamentary

Now that you’ve figured out where to file your petition, you would need your estate attorney to help you get the documents together. These documents may include the following:

- petition for probate

- Note: You will need the contact information of the decedent’s closest living relatives, even if they have been excluded from the will. They need to be notified of the petition and given the chance to object, if they wish to.

- the original last will and testament

- Note: DO NOT un-staple the last will and testament even when you are trying to scan or photocopy it!

- the original death certificate

- Note: Try to get at least 5 or more original copies of the death certificate. You will need this with the banks and other institutions to prove the death of the decedent.

- a copy of the funeral bill

- waivers

- Note: If you can get a waiver from decedent’s closest living relatives, have them sign this document to make the estate proceeding run faster. If they refuse to sign a waiver, you will need the court to issue to them a citation.

- Citation

- Note: This is used when the decedent’s closest living relatives refuse to sign a waiver.

- proposed order

- affidavit of heirship

- family tree

- due diligence affidavit

- affidavit of service

- affidavit of comparison

An attorney will also appear in court on your behalf. If you are like most people and you don’t have any experience drafting legal documents or appearing at court hearings, it is better to hire the services of an attorney to handle your petition to ensure that there are no delays in the issuance of the letters testamentary.

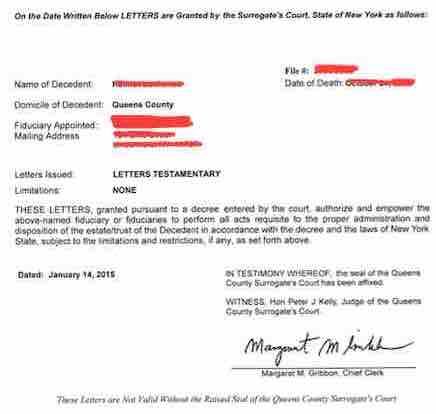

What do letters testamentary look like

As an example for your reference, here is a redacted picture of letters testamentary obtained by our law firm:

You often need more than one since each bank and government agency would require an original. Also, some institutions require a more official-looking document. This is why the court can also issue a Certificate of Appointment of Executor, which is printed on a watermarked blue and red paper and looks similar to a death certificate, birth certificate or marriage certificate.

Here is a redacted picture of a Certificate of Appointment of Executor obtained by our law firm:

How long does it take to get letters testamentary

It typically takes a few months to get letters testamentary. However, when the petition for probate is contested, i.e. an heir of the decedent is challenging the will, getting letters testamentary may take years. In some cases, the petition for probate is denied, and the decedent’s estate is distributed in accordance with New York laws of intestacy. Although getting the letters is only one of the steps of the probate process, it is the most important step. Letters testamentary allow you to begin collecting the assets of the decedent and administering the affairs of the estate.

If the person who died did not leave a will, the document will be similar and with similar powers, but it will be called “Letters of Administration,” and the Certificate will be called “Certificate of the Appointment of Administrator.”

What can letters testamentary do

When a person dies, banks won’t allow you to access the decedent’s bank accounts without presenting them with letters testamentary or letters of administration. This is usually what prompts people to get letters testamentary: to access the decedent’s bank accounts. However, besides accessing the bank accounts, there’s a lot of power one can do with letters testamentary.

Letters testamentary permit a person to act on behalf of an estate of a person who died with a will. In other words, once letters testamentary are issued, you would represent an estate like a president represents a company or a mayor represents a town – you will have the legal authority to make decisions on behalf of the estate. Here are some of the things a person can do once they are appointed as executor of an estate through the issuance of letters testamentary by the Surrogate’s Court:

- Collect the assets of the decedent

- This includes accessing the decedent’s bank accounts; collecting rental fees from decedent’s real properties; collecting debts owed to decedent.

- File a case against persons you believe has assets of the decedent taken prior to or after the decedent’s death

- File a personal injury and wrongful death claim on behalf of the decedent

- Obtain a tax id number for an estate from the federal government

- Open an estate bank account

- Transfer assets from the decedent’s name to the name of the estate

- Pay debts of the decedent

- Distribute the estate assets to the beneficiaries of the estate, after obtaining proper waivers or providing an accounting

All of the above would be impossible to do without letters testamentary. The banks will not give you information and will not transfer the assets. The county recorder will not record property deeds. A buyer will not buy estate property from you.

Who qualifies to receive letters testamentary

A person who is nominated by will to be an executor of an estate does not have the power or authority to act on behalf of an estate until they apply for, and are issued, letters testamentary by the Surrogate’s Court. In other words, a will may say that you are the executor, but you are not an executor until the court says you are. You are simply nominated as an executor in the will, but only a court can declare you as an executor by the issuance of letters testamentary. You do not have the power to represent the estate until the court says so and issues an order (called Letters Testamentary) that gives you that authority.

To apply for and obtain letters testamentary, you not only have to be nominated by the will, but you also need to meet other minimum qualifications.

- be over the age of 18

- not a convicted felon

- have the mental capacity

- not have issues with drugs or alcohol

- not suspected of dishonest conduct

Even if you have been issued letters testamentary, you can still be removed as executor by a beneficiary who claims you have willfully and wastefully dissipated estate property, willfully refused to obey a lawful order of the court, or made a false suggestion of material fact in your application for letters testamentary. You can defend yourself, however, using estate funds, for as long as you are successful in this defense.

If you would like to obtain letters testamentary, you may need the assistance of an attorney. We at the Law Offices of Albert Goodwin are here for you. We have offices in New York City, Brooklyn, NY and Queens, NY. You can call us at 212-233-1233 or send us an email at [email protected].