How to Establish Kinship for Cousin Inheritance in New York City

When a person dies in New York without a will and their closest living relatives are cousins, the court will distribute their estate only after a kinship proceeding.

You will need a New York City kinship attorney to guide you through the process.

The cousins will have to prove that the decedent did not have a spouse, descendants, siblings, aunts and uncles, nieces or nephews, living parents, and other cousins besides those already known.

In this article, we explain the cousin inheritance process and how we can help.

Steps of the Kinship Process

Here is an overview of the kinship process, step-by-step:

-

The Public Administrator takes charge

The court appoints the public administrator to be in charge of the estate. The public administrator collects and holds the decedent’s assets, looks for relatives, and notifies the closest living relatives they find.

-

The Court appoints a guardian

The court will appoint a guardian, who is an attorney who looks out for the interests of unknown or missing heirs.

-

The Public Administrator notifies the cousins

The public administrator notifies the cousins that their cousin died and there is an inheritance. When you get a notification that you are a cousin in a New York proceeding, it’s best to speak to a New York kinship attorney.

-

The cousins respond to the notice.

It is important to timely respond to a notification, preferably through an attorney.

-

The cousins file a request for a kinship proceeding

Your attorney must file a request for a kinship proceeding, otherwise cousins will lose their inheritance.

-

The cousins collect documents

The cousins and a genealogist hired by the cousins must gather official documents that prove they are related to the deceased. It includes documents going back generations to identify common ancestors. You would need certified or original birth and death certificates, marriage certificates, census records, probate records and other documents.

-

The cousins identify all known cousins

The known cousins have to identify all other cousins and prove to the court that no other cousins exist. This includes proving their death if they’ve since passed away. This task can be daunting, especially when families are large, spread out, or have lost touch over the years.

-

The cousins notify all known cousins

If the investigation process uncovers more cousins, the public administrator will also notify them. The court requires that they notify and give a chance to come forward to all potential heirs. This ensures no rightful heirs are overlooked.

-

The cousins summarize the evidence

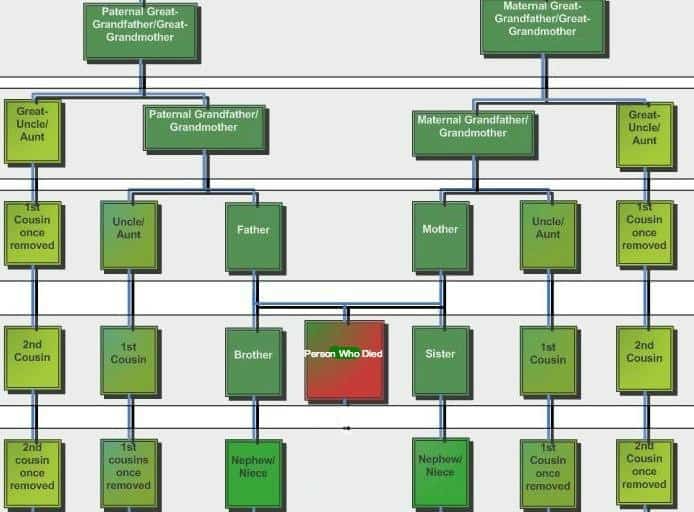

It is up to the cousins and their attorneys to summarize the evidence in affidavits, exhibits, family trees, and testimony.

-

The cousins request a hearing

Once attorneys for the cousins gather all the evidence, they can request a hearing with the Surrogate’s Court.

-

The court holds kinship hearings

Kinship hearings are a key step where the court reviews the evidence and determines the lawful heirs. At kinship hearings, the judge or a referee hears testimony from the genealogist, third parties and the cousins.

-

The referee issues a report

After the hearing, a referee reviews all the submitted evidence and issues a report to the judge.

-

The guardian issues a report

The guardian issues a report that usually states there are no unknown or missing heirs.

-

The judge issues a decree

The judge reviews the two reports and typically issues a decree of kinship formally identifying the heirs. Sometimes, the judge requests a follow-up. This would mean we would have to go back to some of the previous steps before the judge would be able to issue the decree.

-

The Public Administrator files an accounting

Once the court decrees the rightful heirs, the public administrator will present them with an accounting. The accounting is a set of schedules of all of the assets and expenses of the estate and the proposed asset distributions.

-

The Public Administrator distributes assets

Once the cousins review and approve the public administrator’s accounting, the public administrator will mail the cousins checks for their respective amounts of the inheritance.

The Public Administrator Is In Charge of Cousin Estates

When the decedent’s closest living relatives are cousins, they will not be allowed to administer the decedent’s estate. Instead, the court will appoint a public administrator to be in charge of the estate.

The public administrator will do the following:

- Collect and hold the decedent’s assets.

- Locate all the cousins they can.

- Notify all the cousins they can.

- Ask the cousins to step forward and prove their relationship to the decedent and tell the court if they know of any other cousins.

The Court Requires Due Diligence From the Cousins

In a kinship proceeding, the court requires that diligent efforts are made to identify and notify any potential heirs of the deceased. This due diligence mandated by the court involves online searches and public record reviews. In some cases, it may require publishing notices.

The Court Holds Kinship Hearings

Kinship court hearings follow the trial rules, although in a more relaxed setting than a typical trial. Hearings involve testimony from genealogists, family members, and disinterested witnesses regarding how the cousins are related to the decedent.

The hearing is usually conducted by a referee, who works for the judge. After concluding testimony and arguments, a referee issues a report. The judge issues their decree based on the report.

The Court Requires Testimony of a Disinterested Person

In kinship cases, the court prefers the testimony of a disinterested person who knew the decedent and his family. Disinterested means someone who does not stand to inherit.

If you cannot find a completely disinterested person, a person who is related to one of the cousins can testify. Even a child or spouse of one of the cousins.

A genealogist hired by the cousins is also considered to be a disinterested person, whose testimony the court will accept. However, since the genealogist did not know the decedent and their family, they will only be able to testify about the documents.

In our kinship cases, we typically produce testimony of a person who does not stand to inherit, a genealogist, and one of the cousins, in order to give the court a complete picture.

The Judge Issues a Kinship Decree

After the judge reviews the guardian referee’s and guardians’ report, the judge issues their final decree deciding the case. This kinship decree formally declares whether or not the court finds the claimants have satisfactorily proven their familial relationship to the deceased.

If the judge determines the alleged heirs have successfully established rights as the decedent’s closest living relatives, the decree names those individuals as legal heirs entitled to inheritance distribution.

The judge can also request more proceedings if not fully satisfied before issuing a final heir-naming decree.

The Public Administrator Splits the Estate 50/50 Between Maternal and Paternal Cousins

The estate gets split 50/50 between maternal and paternal cousins. Even if the decedent was much closer to some cousins, inheritance law focuses solely on familial lines and divides the estate accordingly.

Since each cousin side shares 50%, cousins on the more populous side will get less per cousin than cousins on the other side.

We have helped many cousins successfully inherit under New York law. With the benefit of our experience, you can feel confident your inheritance rights are protected. We are located in Midtown Manhattan in New York City. You can call us at 212-233-1233 or send us an email at [email protected].