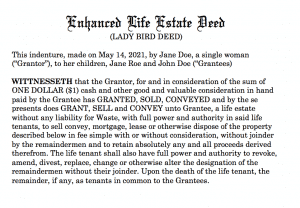

Lady Bird Deed in Florida – Also Known as Enhanced Life Estate Deed

A lady bird deed is a popular name for an Enhanced Life Estate Deed. It allows an owner the unrestricted use, possession, and enjoyment of a property during his lifetime, with an automatic transfer of the property to a named beneficiary upon death without such property passing through probate.

Although the lady bird deed is recognized in five states, it is most popular as a Medicaid and estate planning tool in Florida. In fact, the term “lady bird deed” comes from a fact pattern used by a Florida lawyer in the 1980’s for his teaching materials. He used President Lyndon Johnson and his wife, Lady Bird Johnson, as an example of an enhanced life estate deed. This enhanced life estate deed subsequently became known as the lady bird deed.

Florida Lady Bird Deeds

Lady bird deeds in Florida are rooted in common law. Oglesby v. Lee, 73 Fla. 39, 73 So. 840 (1917); Aetna Ins. Co. v. La Gasse, 223 So.2d 727 (Fla. 1969). In Oglesby, the father’s execution of a deed in favor of his daughter to transfer such property upon his death, but reserving upon himself the right to sell the property during his lifetime, resulted to the daughter’s divestment of interest when the father, indeed, sold the property during his lifetime.

Today, the 2019 Florida Uniform Title Standard 6.10 to 6.12 adopted by the Florida Bar discusses enhanced life estates or the lady bird deeds. Although there is no governing statute in Florida on lady bird deeds, this Florida Uniform Title Standard represents the consensus view of the Real Property, Probate and Trust Law Section of the Florida Bar.

In Standard 6.10, it states for Enhanced Life Estate: Deed for Non-Homestead Property:

“The holder of a life estate in a non-homestead property coupled with the power to sell, convey, mortgage, and otherwise manage the fee simple estate, can convey or encumber the fee simple estate during the lifetime of the holder without the remainderman.”

Thus, the language of the lady bird deed must be clear, specific, and properly drafted to include words, giving the life tenant the full power and authority to convey or encumber the property, without the consent of the remainderman. If one plans to use the lady bird deed for estate or Medicaid planning, it is best to seek help from a qualified lawyer in drafting this deed. Mistakes in writing could lead to an interpretation similar to a life estate deed, which could result to the holder unable to dispose of the property without the consent of the remainderman. To know differences between lady bird deed, life estate deed, and transfer on death deed, click here to read through our previous blogpost on lady bird deeds in general.

In Standard 6.11, it states for Enhanced Life Estate: Deed for Homestead Property:

“A life tenant with an interest in homestead property, coupled with the power to sell, convey, mortgage and otherwise manage the fee simple estate, can convey or encumber the fee simple estate during the lifetime of the holder without the remainderman.”

The life tenant is the owner of the property that has granted upon himself/herself the unrestricted right to use, enjoy, and possess the property. The remainderman is the person named by the life tenant who will inherit the property upon the life tenant’s death. Homestead property is property used as the primary home. In Standard 6.11, the Florida bar confirms that an enhanced life estate deed may be used to transfer homestead property to a remainderman upon death of the life tenant, but if such homestead property is sold by the life tenant prior to his/her death, the buyer acquires it free from the remainderman’s claims.

Standard 6.12 provides a limitation for the lady bird deed and discusses the Enhanced Life Estate: Remainderman and Homestead Property:

“The remainderman in homestead property, wherein the life tenant reserved the power to sell, convey, mortgage, and otherwise manage the fee simple estate, acquires fee simple title upon the death of the life tenant only when not in violation of constitutional restriction on devise of homestead.”

Florida has constitutional homestead protections reserved to spouses and minor children. If a transfer is made to a third person when there is a surviving spouse and minor children, such transfer through a lady bird deed, even if recorded, is considered void. Despite the lady bird deed, the homestead property will still pass to the surviving spouse, giving the spouse a life estate interest in the property with the remainder to the decedent’s lineal descendants (including any minor children).

Title Insurance

Ultimately, the validity of a lady bird deed would depend on the title insurance company. Fortunately, the big title insurance companies in Florida, such as The Fund (one of the most popular title insurance companies with real estate attorneys) honor lady bird deeds.

Some title insurance companies, however, would treat lady bird deeds differently. Sometimes, a life estate holder who retains the right to sell the property would be required by the title insurance company to get the consent of the remainderman in any real estate transfer to avoid the potential for litigation. For this reason, it is important to get the advice of competent and experienced counsel in drafting lady bird deeds, getting title insurance companies, and having the deed recorded.

Benefits

Despite the limitations of a lady bird deed in Florida, it is still prevalently used because of estate planning, Medicaid planning, property planning, and tax planning.

First, for purposes of estate planning, a lady bird deed allows the transfer of property to a third person upon death of the owner without such property going through probate. Thus, the remainderman need only to record the short-form death certificate in order to transfer the property to him/her. This allows the remainderman the opportunity to acquire the property faster and avoid costly legal probate proceedings.

Second, because the lady bird deed automatically transfers the property upon death without need of probate, the government will not be able to claim for reimbursement or recovery of Medicaid expenses upon a Medicaid recipient’s death.

Third, a transfer using a lady bird deed is not considered an asset transfer for purposes of the lookback rule for Medicaid eligibility. As a general rule, any asset transfer within a 60-month period prior to applying for Medicaid will disqualify a Medicaid applicant for a particular period of time in availing of Medicaid benefits. The rationale for this lookback rule is the fact that such Medicaid applicant could have used such asset to finance his medical expenses, instead of seeking government assistance. However, the Florida Medicaid manual specifically addresses lady bird deeds (as enhanced life estate deeds) and states that these deeds are legitimate and not the considered a transfer of assets.

Fourth, a lady bird deed allows the owner to retain his homestead exemption. In Florida, a $25,000 exemption is applied to the first $50,000 of the property’s assessed value if the property is used as the permanent residence of the owner. An additional exemption of up to $25,000 will be applied if the property’s assessed value is between at least $50,000 to $75,000. Thus, an owner who uses the property as his permanent residence enjoys lower property taxes due to the homestead exemption. A lady bird deed does not disturb this homestead exemption (for as long as the life tenant is the grantor) because the owner retains control over the property and may revoke the interest of the remainderman at any time prior to death. Thus, the interest of the remainderman does not vest until after the owner’s death. For this reason, the life tenant retains his property’s homestead exemption in a lady bird deed.

Lastly, the owner does not need to pay large taxes upon execution of the lady bird deed because the transfer to the remainderman can still be revoked at any time. Thus, there is no need to pay gift taxes, because the gift is incomplete until the death of the life tenant. Although the property does not go through probate, the property is still included in the estate tax returns for purposes of transfer of the property to the remainderman.

The execution of a lady bird deed is one way to successful estate planning, but it is not the only way. Depending on the circumstances of the case, a lady bird deed may be proper. At times, a revocable living trust might be better. Because of the nuances of each case, it is always best to consult with an experienced trust and estates lawyer who can help you create a holistic estate plan that will address all your needs and purposes.

We at the Law Offices of Albert Goodwin are here for you. You can call us at 1-800-600-8267 or send us an email at [email protected].