Medicaid Estate Recovery in New York and How We Can Help Avoid It

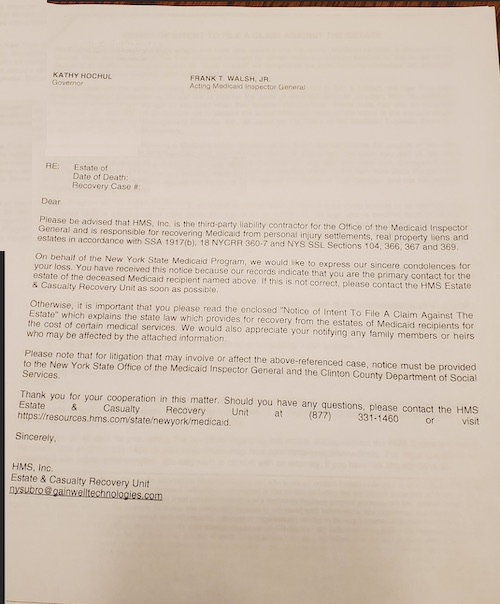

Medicaid estate recovery in New York is more common than people realize. Under Social Services Law (SSL) Section 369, the state of New York may and is actually required, to recover Medicaid benefits upon the death of a recipient.

If you have concerns about Medicaid estate recovery and you would like to speak with an attorney, you can send us an email at [email protected] or call us at 212-233-1233.

Who does Medicaid estate recovery in New York apply to and when does this happen?

It applies to persons who received Medicaid benefits at the age of 55 or older or to persons who, regardless of age, were permanently institutionalized prior to their death.

How much can be recovered?

The state can recover the amount of Medicaid correctly paid from the date the recipient turned 55 years of age or the date of permanent institutionalization, whichever occurs first.

Where is it taken from?

Medicaid recovery is taken from the estate of a person upon their death.

Simply put, if a person received Medicaid at the age of 55 and up, or if a person, whatever their age, permanently resided in a medical institution, the state may recover correctly paid Medicaid from the assets of their estate upon their death.

What is included in a person’s estate?

Under 18 NYCRR 360-7.11, for purposes of Medicaid estate recovery, a person’s estate includes anything that they have legal title or interest in at the time of death. This includes real property (land, houses, buildings), personal property (belongings), and other assets that are passed to heirs with or without a will. To the extent of a person’s interest immediately prior to death, the estate includes assets conveyed to a survivor, heir or assign through a joint tenancy, tenancy in common, survivorship, life estate, living trust or other arrangements. It also includes jointly owned financial institution accounts, jointly held real property, life estate interests, interests in certain trusts and annuities regardless of whether there is a named beneficiary or right of survivorship.

When is Medicaid Estate Recovery in New York prohibited?

There are instances that Medicaid estate recovery is not allowed, these are:

- If the deceased Medicaid recipient’s surviving spouse is still alive, recovery cannot be made during the spouse’s lifetime.

- If the deceased Medicaid recipient has a surviving child who is either:

a) Under the age of 21. In this case recovery can only be made when the child reaches the age of 21; or

b) Certified blind or disabled. In which case recovery cannot be made during the child’s lifetime and can only be pursued when the child dies. - If one of the following relatives is residing in the home of the deceased Medicaid recipient:

a) A sibling with an equity interest in the home who lived there at least one year before the recipient was institutionalized and has, since then, lawfully resided in the home continuously. In this case recovery can only be made if the sibling no longer resides in the home or if the property is sold; or

b) An adult child who has lived in the home for at least two years immediately before the recipient was institutionalized, who provided care that may have delayed the institutionalization, and who has, since then, lawfully resided in the home continuously. In this case recovery can only be made if the adult child no longer resides in the home or if the property is sold. - Income, resources and property belonging to an American Indian or Alaskan Native as described in detail in 02 OMM/ADM-3.

Can Medicaid Estate Recovery in New York be waived?

Yes. Medicaid estate recovery may be waived by the state on the basis of undue hardship that may befall the surviving heirs or beneficiaries of the deceased’s estate.

Surviving heirs, beneficiaries or fiduciaries of the estate may request that the state waive the Medicaid estate recovery, either in whole or in part, if it will result in undue hardship. This can be done buy requesting a consideration of undue hardship within 30 days of the notification of Medicaid estate claim.

Undue hardship may exist when the asset subject to recovery is the sole income-producing asset of the beneficiary such as a family farm or family business and income produced by the asset is limited. It may also exist when the asset subject to recovery is real property that is the primary residence of the beneficiary and is of modest value. A real property is considered to be of modest value if, at the time of the decedent’s death, its value is no higher than 50 percent of the average selling price in the county where the home or property is located.

Other compelling circumstances may also be considered by the state in deciding to waive Medicaid estate recovery due to undue hardship. But, it has been consistently held that the inability of beneficiaries to the estate to maintain a pre-existing lifestyle, or alleged hardship resulting from Medicaid or estate planning methods involving divestiture of assets is not among the instances when the state would waive Medicaid estate recovery due to undue hardship.

What happens to the real properties of the deceased?

A post-death lien, to the extent of the decedent’s interest in the property at the time of death, will be placed on the real property unless the state defers or waives the Medicaid estate recovery in the instances mentioned above. This lien serves as a notice to mortgage lenders and prospective purchasers of the Medicaid estate recovery claim against the property.

However, even if there is a lien on the property, recovery by the state may still be deferred if:

- An heir or survivor lawfully and continuously resides in the home prior to the death of the Medicaid recipient and is unwilling to sell the property;

- The Medicaid claim cannot be paid in full unless the property is sold;

- The heir or survivor demonstrates an inability to obtain financing to pay the estate claim;

- The heir or survivor enters into a written agreement with the Medicaid program to pay the amount of the claim under a reasonable payment schedule with reasonable interest;

What happens if the recovery from real property subject to a post-death lien is deferred for any of these four reasons?

The lien is filed in the county clerk’s office in the county where the property is located and shall remain on file to protect the interest of the Medicaid program to the extent of the claim against the recipient’s estate, less any payments actually received.

Until when will Medicaid Estate Recovery in New York be deferred?

Medicaid estate recovery will be deferred only until:

- The death of the dependent, heir, or survivor; or

- The sale, refinance, transfer or change in title of the real property; or

- The determination by the Medicaid program that the dependent, heir, or survivor is in breach of the repayment agreement.

So to answer the title question, “is Medicaid truly free?” the answer is no, not at all. Knowing why and how Medicaid estate recovery can affect your properties and possibly the lives of your survivors could help you mitigate future inconvenience that you may leave behind. Talk to us to see how we can help you.