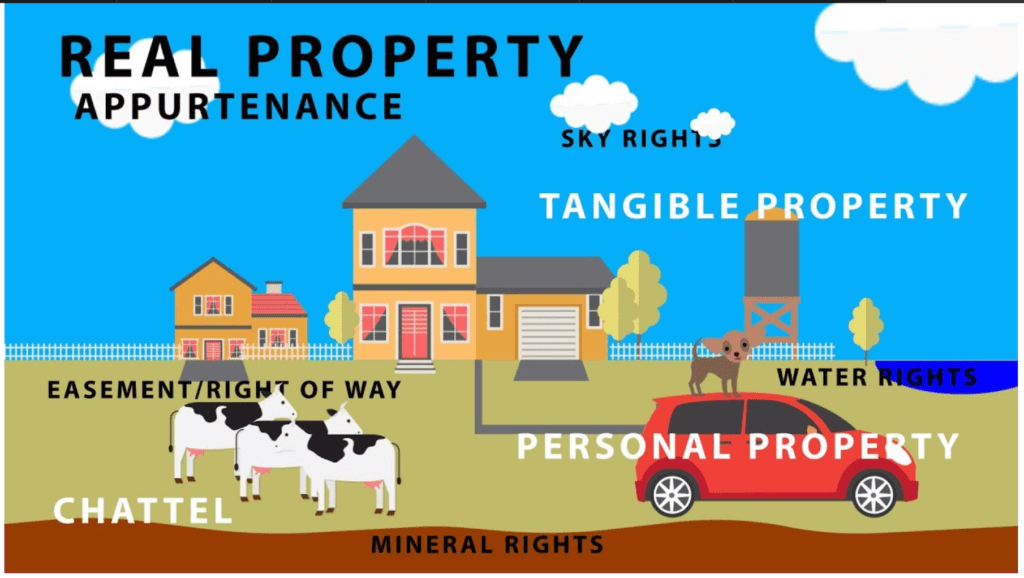

Real Property Definition – lack of movability, built over land or affixed to it

Real property definition includes land and anything built or attached to it. Vacant land is called unimproved land, while objects built or attached to the land are called improvements (e.g. buildings). Both land and improvements are considered real property.

Personal property, on the other hand, shall not be liable to ad valorem taxation. Given this provision, it is important to define what real property is to know whether such property in New York is subject to taxes and assessments or not.

Examples of things included in real property definition

Real property definition and a list of real property examples can be found in New York Real Property Law, Section 102 (12). This list includes:

-

- land, above and under water, including trees, mines, minerals, quarries and fossils

- buildings and other structures, substructures, and super structures, such as bridges, wharves, piers

- surface, underground or elevated railroads and structures

- telephone and telegraph lines, wires, poles, supports, when owned by a telephone company

- mains, pipes, and tanks for conducting steam, heat, water, oil, and electricity

- boilers, ventilating apparatus, elevators, plumbing, heating, lighting and other power generating apparatus

- forms of housing, such as trailers or mobile homes, except those which are recreational vehicles, unoccupied and for sale, or located within the boundaries of the assessing unit for less than 60 days

- special franchises for water, steam, light, power, electricity, gas or other substance

- lines, wires, poles, supports, and enclosures for electrical conductors

- spent fuel pools and dry cask storage systems.

Personal property, on the other hand, is generally movable property. The confusion arises when personal property is affixed to real property. The question raised then is whether such personal property becomes real property by reason of such attachment to land.

The assessor uses several principles in determining whether personal property can be considered real property for tax and assessment purposes.

Built over land or affixed to it

Generally, real property definition includes things that are built under or over land or affixed to it, it is real property. An example would be a jacuzzi or hot tub affixed in the garden. Also, if the article would ordinarily remain in the building once it is sold, it is considered real property. Examples are radiators, built-in cabinets, and airconditioning units, which are generally movable, but when affixed to land, can become real property.

Lack of movability

Another principle used in determining whether an article is included in real property definition is the ability and cost involved in moving the property without injury to itself or the building. For example, a mobile home that is located in camping grounds might be considered personal property, but if it is attached to the ground with gas, water, telephone, or cable television installations, it will be considered as real property.

Intention of permanence

The intention of permanence will also determine whether something is included in real property definition. An above-ground swimming pool bolted to the ground that can be removed from the land is only real property if it is left there all year round with no intention of packing it away. In that case, the owner installed it with the intention of having it there permanently.

Tax law connected to real property definition

Under NY Real Property Tax Law (RPT) § 300, all real property within the state that is included in real property definition shall be subject to real property taxation, special ad valorem levies, and special assessments, unless exempt from law.

The assessor will use the above principles in determining whether an article or fixture is real property subject to taxes. Should you have issues on real property tax assessments, which may include real property definition, we at the Law Offices of Albert Goodwin are here for you. You can call us at at 1-800-600-8267 or email at [email protected].