S Corp vs. C Corp: What are the Differences and Why it Matters

When you want to start a business, the first thing you need to decide on is the type of legal structure you want your business to operate in: sole proprietorship, partnership, limited partnership, limited liability company, or a corporation. There are several differences among these entities, and it is always best to consult with a lawyer regarding the appropriate legal structure based on your goals and expectations of the performance of your business operations.

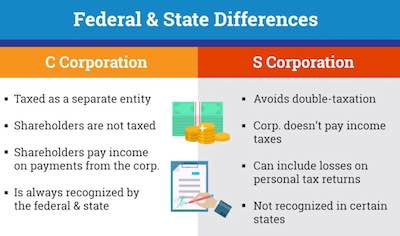

If you have decided to form a corporation, then you must have heard of an S Corp vs. a C Corp. The differences between these two. are not just a letter. Their main differences can be categorized based on corporate taxation, treatment of losses, ownership, and profit distribution.

Differences Between S Corp vs. C Corp

A corporation is created by default as a C Corp. When you file your articles of incorporation with the Department of State and you are given the certificate of incorporation, the corporation is automatically a C Corp. If you’d like your corporation to be an S Corp, all the shareholders need to consent to elect to be an S Corp. The unanimous approval of the shareholders is manifested by all of them signing IRS Form 2553, an Election by a Small Business Corporation form. The corporation must also meet the following requirements in order to be an S Corp: (a) be owned only by US citizens or US residents; (b) have no more than 100 shareholders; and (c) have only one class of stock.

Now, the main question remains: why would shareholders elect to be an S Corp vs. a C Corp?

Corporate Taxation

The major difference between an S Corp vs. a C Corp is corporate taxation. The C Corp is taxed on its net taxable income with a tax rate of 21%. If the C Corp distributes profits to its shareholders, that dividend is taxed again. The S Corp, on the other hand, enjoys pass-through taxation. In pass-through taxation, the net taxable income of the S Corp is immediately reported as income by the shareholders in proportion to their percentage of ownership in their US individual income tax return, IRS Form 1040, and other related forms.

For example, ABC Corp. has two shareholders, John and Michael, who own 60% and 40% respectively. In 2020, ABC Corp. reported a net taxable income of $100,000. If ABC Corp. is a C Corp, ABC Corp. will pay corporate income tax of $21,000. If ABC Corp. declares dividends of $20,000, John will receive $12,000 and Michael will receive $8,000. This amount will be taxed again at a dividend tax rate depending on John and Michael’s tax bracket and whether the dividend is qualified or unqualified.

If ABC Corp., on the other hand, is an S Corp, its net taxable income of $100,000 will simply pass through ABC Corp. and be taxed directly to its shareholders. There is a presumed distribution of the entire net taxable income to the shareholders. In this case, if John’s tax bracket is $40,526 to $79,999, John’s $60,000 presumed income from ABC Corp. will be taxed at 22%, amounting to $13,200. If Michael, on the other hand, is in the tax bracket of $9,951 to $40,525, Michael’s 40% presumptive income distribution of $40,000 will be taxed at 12%, amounting to $4,800.

In the C Corp, there is double taxation: corporate income tax and tax on dividends distributed to shareholders. In the above case, the total tax paid by S Corp and its shareholders would be $21,000 plus the dividend tax if and when ABC Corp. declares dividends. In an S Corp, the net taxable income is immediately reported as income by the shareholders (even if they did not actually receive the money), and the shareholders pay income tax based on their tax bracket. There is no double taxation. In the example above, the total tax paid by the S Corp and its shareholders is $18,000.

Treatment of Losses

In the same way, the C Corp and S Corp differ greatly in the treatment of losses. If the C Corp did not earn any income and sustained losses (meaning their allowable deductions are higher than their taxable income), the C Corp will not pay tax. It may, however, be allowed to carry forward to the next tax period its net operating loss under the IRS provision called loss carryforward.

The shareholders of S Corp, on the other hand, can immediately benefit from the losses of the corporation. Since there is a presumed distribution to the shareholders of the S Corp, the losses, similar to profits, will be distributed accordingly, and the shareholder can offset the loss of the S Corp to its income.

In the example above, suppose instead that ABC Corp.’s net operating loss for the year was $50,000. If ABC Corp. is a C Corp, it could carry forward its loss of $50,000 in the next year and offset it with its income. So if ABC Corp. earned $100,000 next year, it could offset the $50,000 loss, and ABC Corp. would only pay the 21% corporate income tax on $50,000 equivalent to $10,500.

If ABC Corp. is an S Corp with a net operating loss of $50,000, John, who owns 60%, can report a $30,000 loss in his income tax return, and Michael can report his proportionate 40% share of the loss amounting to $20,000. Assuming that John had a net taxable income for that year of $70,000 (with a tax rate of 22%), he can offset the $30,000 loss from ABC Corp. and would then only be liable to pay income tax on $40,000. This would put John in the 12% tax bracket (rather than 22%) and would translate into huge savings from $15,400 (70,000 * 22%) down to $4,800 (40,000 * 12%).

Ownership

An S Corp is more restrictive, in the sense that it can only be owned by US citizens and US residents, have no more than 100 shareholders, can only have one class of stock, and cannot be owned by C Corps, other S Corps (with some exceptions), LLCs, partnerships, and trusts. Thus, the S Corp’s stock would have more restrictions to ensure that the stock would not go to an eligible shareholder, which could lead to IRS revoking the S Corp status. C Corps, on the other hand, can be owned by foreigners and other corps, have more than 100 shareholders, and can have multiple classes of stocks.

So, if the company would like to be acquired someday or would like to offer its stocks to the public through an IPO, a C Corp would be a better option.

Distribution of Profit

Because a C Corp can have multiple classes of stock vs. an S Corp with only one class, a C Corp has more flexibility in distributing profits. A C Corp can have both common stock and preferred stock where the preferred stock is preferred with respect to dividends. So, a C Corp can declare that dividends be distributed to the preferred stock and not to the common stock.

The S Corp, on the other hand, only has one choice in distributing dividends because it only has one class of stock, which is common stock.

Conversion from S Corp to C Corp. and back

To convert an S Corp back to a C Corp, more than 50% of the shareholders holding both voting and non-voting stock have to agree to the revocation of the S Corp status. However, once the S Corp status has been revoked, the shareholders can only convert to S Corp once again 5 years after the revocation and only with the unanimous consent of the shareholders. This period of conversion from S Corp to C Corp may be shortened with IRS approval.

S Corp Election with New York State

Once a corporation becomes a federal S corporation, the corporation can now elect to be treated as an S Corp under New York laws. Similar to federal law, all of the corporation’s shareholders must consent to the New York’s election.

If you have been seriously thinking about operating a business and wondering what C Corp vs. an S Corp is, we at the Law Offices of Albert Goodwin are here for you. We have offices in New York City, Brooklyn, NY and Queens, NY. You can call us at 212-233-1233 or send us an email at [email protected].