Two Names on a Deed, One Person Dies, in New York City

When two people purchase real property together, two names are on the deed. What happens when one person dies? Who now owns the property?

Check the Deed

When two names are on a deed and one person dies, the first thing a lawyer would scrutinize is the language of the deed. There are generally three types of joint ownership in New York: joint tenancy with rights of survivorship, tenancy in common, and tenancy by the entirety. If the deed is silent as to the kind of ownership, the presumption is that the co-owners own it under tenancy in common.

The word “tenants” in real estate co-ownership should not be confused with “tenant” in a lease since they are different concepts. A tenant in a lease agreement is the lessee, a renter who does not own the property, while a tenant in a real estate ownership is a co-owner.

In a tenancy in common, the death of one owner in the deed transfers his interest to his estate and not to the other surviving co-owner. In a joint tenancy with rights of survivorship, the death of one person in the deed results in the transfer of the entire interest on the real property to the remaining survivor. The same rule of survivorship governs tenancy by the entirety, although tenancy by the entirety only applies to spouses who purchase real property together.

In determining who will be the owner of the property when two names are on the deed and one person dies, the lawyer will first check the language of the deed. If we’re lucky, the deed will already state the type of ownership among the co-owners. For example, it will be A and B, as joint tenants, or A and B as tenants-in-common, or A and B as joint tenants with rights of survivorship, or A and B as tenants by the entirety. In New York, joint tenants and joint tenants with rights of survivorship are used interchangeably and mean the same thing.

What if the Deed Doesn’t State the Type of Ownership?

When there are two names on the deed, one person dies, and there is no description of how the property is owned, the presumption is that it is owned as tenants-in-common if the co-owners are not spouses. If the co-owners are spouses, the presumption is that the ownership is tenancy by the entirety. This presumption, however, can be rebutted with contradictory evidence.

Examples

A and B, spouses, purchase real property together. How do the spouses own the property if the deed is silent? In this case, the spouses hold the property as tenancy by the entirety, unless the deed says otherwise. If A dies, the entire real property will be owned by B.

A and B, friends and real estate partners, purchase real property together as an investment. The deed is silent as to the type of ownership. In this case, the presumption is tenancy in common, with each owning 50%. Why? Because they are not spouses. When A dies, his 50% interest in the real property will go to his estate, which will be distributed to his heirs or beneficiaries, as the case may be. B cannot claim ownership over the entire property since the deed does not say joint tenancy with rights of survivorship.

A and B, parent and child, purchase real property together as joint tenants. A, the parent, dies. B goes to the land registry of deeds and submits an affidavit and the certified copy of A’s death certificate. The property is now transferred in B’s name. B’s siblings question his ownership over the property, claiming that A’s interest belongs to the estate. Are B’s siblings correct? No, the property is owned by A and B as joint tenants with rights of survivorship. Upon A’s death, the property automatically transfers to B, the remaining survivor, and not to the estate. If B’s siblings are able to show that the parent, A, transferred the property to B, child, under undue influence, the deed with A as grantor and A and B as joint tenants with rights of survivorship may be set aside.

A and B are husband and wife. A had real property prior to the marriage. After the marriage, A deeded ½ or 50% of the property to B, his wife. B had children from the prior marriage. When B died, A claimed the entire property on the ground that as spouses, they held the property as tenants by the entirety. B’s children from a previous marriage claim that B’s 50% interest in the real property belonged to B’s estate. Are B’s children correct? Yes, the real property is not owned as tenants by the entirety, even if A and B are spouses because they did not get the property together. If A transferred it to A and B, then the ownership would be tenancy by the entirety. But in the deed, A transferred only 50% to B. The presumption, in this case, is that the property is owned as tenants in common and B’s 50% interest goes to her estate.

Real Life Application of Different Types of Co-Ownership

Tenancy by the entirety only exists among spouses. Business partners usually own the property as tenants in common. Joint tenancy with rights of survivorship often appear in deeds involving parents and children.

How to Transfer Joint Tenancy or Tenancy By The Entirety Property

When a property is owned as joint tenants with rights of survivorship or tenancy by the entirety, the property is not considered part of the probate estate. It automatically transfers to the surviving co-owner upon the death of the other co-owner.

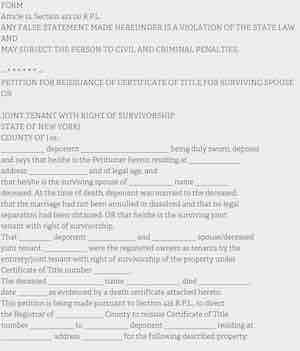

State laws vary as to how this transfer is effected. Usually, the surviving co-owner simply goes to the local land records office, sometimes called Register of Deeds or County Recorder or another name, depending on the state, and submits a certified copy of the death certificate of the co-owner and a declaration or affidavit from the surviving co-owner/spouse. The affidavit or declaration will typically contain a legal description of the property, a statement that the property was held in joint tenancy with rights of survivorship or tenancy by the entirety, a reference to the deed that transferred the property to the joint tenants or tenants by the entirety, the name and date of death of the deceased joint tenant, and the name and signature of the surviving sole owner.

Joint Tenant’s Termination of Joint Tenancy

A joint tenant can terminate joint tenancy in two ways: (a) selling his own interest in the property to a third party; (b) executing and delivering a deed to the other joint tenants that evidences an intent to sever the joint tenancy; or (c) filing an action for partition.

A joint tenant’s severance by deed does not affect the rights of survivorship of the other joint tenants. For example, A, B and C hold the property as joint tenants with rights of survivorship. A wishes to terminate the joint tenancy and sell his share to D. Now, B, C, and D own the property. B and C, with respect to each other’s 1/3 share, are joint tenants with rights of survivorship. D, on the other hand, with respect to B and C, are considered tenants in common.

A joint tenant cannot sell the entire property but only his interest in the property. When the joint tenant sells his interest to a third party, the joint tenancy with right of survivorship terminates, and the new joint tenants own the property under tenancy in common.

The joint tenant cannot dispose of his share via will with the intent of terminating the joint tenancy. The deed will override the will. The property under joint tenancy will not pass through probate and will be transferred to the surviving joint tenant. If the joint tenant seeks to terminate the joint tenancy, the joint tenant must, in his lifetime, either transfer it to a third party, file an action for partition, or execute, deliver, and record a deed of severance to his joint tenants.

Issues in Joint Tenancy With Rights of Survivorship

Although joint tenancy with rights of survivorship is more often seen in real estate, this type of ownership can also appear in bank accounts. Different laws apply in joint tenancy in bank accounts as opposed to real estate.

Because joint tenancy with rights of survivorship avoid probate, many parents own real property in this manner with their children. However, issues always arise when only one child is included in the deed of the property. In this case, the surviving joint tenant who is the deceased joint tenant’s child claims the entire real property, to the exclusion of the other siblings, giving rise to legal disputes.

Setting Aside a Deed of Joint Tenancy After the Death of a Joint Tenant

Questioning the validity of a deed of joint tenancy is similar to questioning the validity of a will.

Some grounds for questioning the validity of a deed of joint tenancy are forgery, fraud, and undue influence. To be successful, we usually use a combination of different grounds to prove that the deed is not valid, such as the employment of fraud and undue influence upon the deceased.

Undue influence occurs when the intent of the grantor has been constrained by a force so strong that it has overcome his own free will. In joint tenancy with rights of survivorship, the property is usually owned alone by the deceased joint tenant. Prior to death, the deceased joint tenant transfers it to himself and the child as joint tenants, to the detriment of the other siblings.

To prove undue influence, medical records of the deceased joint tenant at the time the transfer can be obtained to see whether the deceased was under strong medication that could alter his senses. Other documentary evidence, such as correspondences and notes, and witness depositions, such as the lawyer who drafted the deed, can also be used to prove whether the deceased was under undue influence when the deed was executed. If the deed is set aside, the property then passes through the deceased joint tenant’s probate.

When two names are on the deed and one dies, one should scrutinize the deed to see if there is a description on the kind of ownership between the co-owners. If none, legal presumptions may apply which can be rebutted. If you have issues regarding the transfer of ownership to you after a co-owner dies, we at the Law Offices of Albert Goodwin are here for you. We have offices in New York City, Brooklyn, NY and Queens, NY. You can call us at 212-233-1233 or send us an email at [email protected].