What Does Intestate Mean?

Intestate means the status or condition that occurs when a person dies without a will. Intestate can also mean the rules of succession that apply when a person dies without a will. Intestate can also describe an heir who inherits when a spouse or relative dies without a will.

What does intestate mean as a status or condition?

Intestate is a status that happens when a person dies without a will. Since a will is a direction made by the deceased on how his assets will be distributed upon his death, dying intestate means that the deceased did not leave any direction on how his assets will be distributed, and so, state laws will direct the distribution of his assets.

Although dying intestate normally refers to dying without a will, dying intestate can still happen even if there’s a will. When one executes a will, but does not provide for the distribution of all his assets in the will (such as the absence of a remainder clause), then such person has died intestate with respect to the property not covered by the will.

For example, Michael dies leaving only three properties in New York which he solely owns: a coop in Manhattan, a brownstone in Brooklyn, and a condominium in Queens. In his will, he left his coop in Manhattan with his son, Christopher, and his brownstone in Brooklyn with his wife, Sarah. He did not have any provision in his will for the condominium in Queens nor did he have a remainder clause leaving all the remainder of his assets to a person. In this case, for that particular property in condominium in Queens, Michael is considered to have died intestate because he did not say in his will who will receive it. State laws will then step in to determine who is entitled to the condominium in Queens.

What does intestate mean in terms of succession?

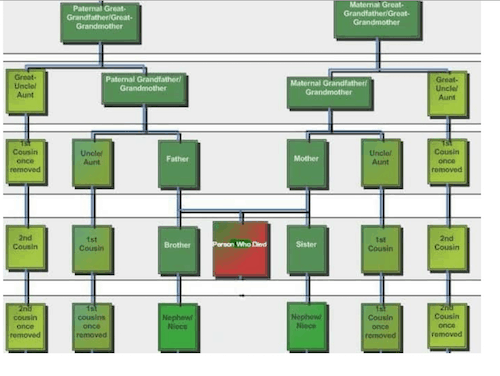

Intestate succession refers to state laws that determine who will receive the property of the deceased who dies without a will. State laws vary on intestate succession, and it is recommended that you seek the advice of a lawyer from your state when you have questions on intestate succession.

In New York, intestate succession is provided under Estates, Powers, and Trusts Law § 4-1.1, which states the descent and distribution of an intestate estate. In general, if the deceased is survived by a spouse and children (or descendants of children), the spouse gets $50,000 plus ½ of the estate, and the balance goes to the children or their descendants by representation. If there is a spouse but no descendants, the entire estate goes to the spouse. If there are descendants but no spouse, the entire estate goes to the descendants. If there are no spouse and descendants, the entire estate goes to the parents. If there are no spouse, descendants, or parents, the entire estate goes to the descendants of the parents by representation. If there are no spouse, descendants, parents or descendants of parents, then to the grandparents or the grandparents’ descendants by representation, but the descendants in this case shall be limited to the grandchildren of the grandparents.

For example, Michael’s sole property when he died was $100,000 in his bank account with no debts. We assume that $100,000 was his net estate Michael was unmarried, but had a child out of wedlock who he was estranged with, Christopher, and survived by his parents, Linda and John. Michael suddenly died at age 30 because of a car accident and so, he had left no will. Who is entitled to the property under the rules on intestate succession in New York?

Under EPTL § 4-1.1, if the deceased dies, leaving descendants (another term for issue), the entire estate goes to the descendants. In this case, since Michael had a child, Christopher, even if he was estranged with Christopher, Christopher receives the entire $100,000, precluding his parents, Linda and John, from receiving anything.

In the same example above, let’s assume that Michael was survived by his spouse, Sarah, his children, Christopher and Christine, and parents, Linda and John. Michael died intestate. Who is entitled to Michael’s estate? Given this scenario, Michael’s spouse, Sarah will get $75,000, which is $50,000 plus ½ of the remaining balance equivalent to $25,000). Christopher and Christine will share $25,000, and get $12,500 each. Michael’s parents, Linda and John, will not receive anything.

If you think that the rules on intestate succession in your state are unfair, or you would like to leave a portion of your property to people not included as an intestate heir, it is advisable that you execute a will so you, and not the state, can direct the disposition of your property.

What does intestate mean when it refers to an heir?

An intestate heir is the person who stands to inherit property, as provided under the state laws on intestate succession. In the first example above where Michael is survived by his son, Christopher, and parents, Linda and John, only Christopher is the intestate heir. In the second example where Michael was survived by his spouse, Sarah, his children, Christopher and Christine, and his parents, Linda and John, Sarah, Christopher and Christine are intestate heirs.

Let’s explore further the example above where Michael left a will, leaving his coop to his son, Christopher, and his brownstone in Brooklyn to his wife, Sarah. Michael did not have any provision in his will regarding the condominium in Queens. Assuming the condominium in Queens is worth $250,000, and Michael is survived by his parents, Linda and John, his wife, Sarah, and his children, Christopher and Christine. Who are Michael’s intestate heirs in this case where he left a will? His intestate heirs with regard to the Queens condominium are Sarah, Christopher, and Christine. If the Queens condominium was sold, Sarah would receive $150, 000 (which is $50,000 plus ½ of the remainder equivalent to $100,000), while Christopher and Christine will receive $50,000 each.

The above rules apply to a deceased who resided in New York before he died without a will. If want to know, ‘what does intestate mean’ or need help in determining who the intestate heirs of your loved one are, we, at the Law Offices of Albert Goodwin, are here for you. We have offices in New York City, Brooklyn, NY and Queens, NY. You can call us at 212-233-1233 or send us an email at [email protected].