Who Owns the Property in a Life Estate

The life estate has become a popular tool for estate planning due to its ease of execution and affordability. If you are considering the execution of a life estate over your house, you must be wondering, “who owns the property in a life estate?” To put simply, both the life tenant and the remainderman are considered joint owners of the property, but in different durations.

What is a life estate?

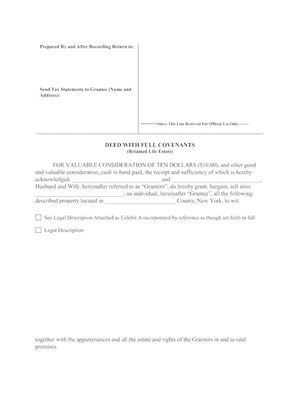

A life estate is an arrangement where one person transfers to another property, reserving for himself the right to use and possess the property for the rest of his life. In a life estate arrangement, there are two parties: the life tenant and the remainderman. The life tenant is the person to whom use and possession is reserved for the rest of his life until death. Once the life tenant dies, the remainderman obtains absolute ownership over the property simply by filing with the County Recorder a certified copy of the death certificate of the life tenant and an affidavit.

In the life estate arrangement, both the life tenant and the remainderman are considered joint owners of the property. However, the life tenant has limited ownership rights because the life tenant cannot sell, dispose, transfer, encumber, or mortgage the property without the consent of the remainderman. Still, the life tenant owns the property in a life estate for most intents and purposes. The life tenant owns the life estate property for purposes of homeowner’s insurance, and the life tenant is still eligible for STAR exemption, veteran’s benefits, and homestead and other tax breaks.

A life estate is irreversible and irrevocable. Once you execute the life estate deed, you cannot take it back without the consent of the remainderman. For this reason, executing this life estate deed is a major decision. You need to consult with a lawyer whether the life estate deed is the most appropriate estate planning tool for your situation, given your objectives.

Life tenant’s rights and duties

As a life tenant, you have the right to use and occupy the property until you die. If you don’t want to live in the property, you can rent it out, and only you will be entitled to the rent and profits of the property. The remainderman is not entitled to the rent and profits of the life estate property while you are still alive and does not have any interest in the property until after you die.

On the other hand, as an owner of the life estate property, the life tenant is responsible for all rights and obligations of a homeowner: maintenance costs, real property taxes, and insurance.

Why execute a life estate?

Most people execute a life estate deed for Medicaid purposes. A life estate, as opposed to an outright gift, will decrease the penalty period that will make you eligible for Medicaid. In addition, since the property under a life estate does not pass through probate, such property will be exempt from the Medicaid estate recovery program.

For example, the penalty period for Medicaid eligibility is computed based on the value of any transfers you have made in the 5-year period prior to applying for Medicaid. If you have a house worth $200,000, you gift it to your son within the 5-year period before applying for Medicaid and you want to enter a nursing home in NYC, you will be penalized with a period of 14.9 months of Medicaid ineligibility from the time you apply computed by the amount you transferred without adequate consideration ($200,000) and the New York City nursing home Medicaid regional rate of $13,415 as of 2022.

What happens if you executed a life estate deed instead of transferring it outright to your son? The penalty period will become smaller because instead of valuing the transfer at $200,000, the transfer will be lesser, computed based on the value of the remainder interest since you have retained for yourself a life estate. The remainder interest and the life estate will be determined based on the remaining life of the life tenant using actuarial tables.

Life estates are a more affordable way to transfer real property to your children in order to be eligible for Medicaid. You can also execute a Medicaid Asset Protection Trust but the legal fees to create a trust can take thousands of dollars, while the execution of a life estate deed is cheaper. Trusts, however, offer more flexibility and its provisions can be customized depending on your objectives. Trusts are recommended for persons with larger estates who don’t only have the family home as their sole asset. Should you need assistance in executing a life estate deed, you can call us at 212-233-1233 or send us an email at [email protected].

Some potential issues to look out for in a life estate

Although there are benefits to executing a life estate deed, you must also be aware of the potential issues you might encounter:

- As previously mentioned, you cannot sell or mortgage the property as a life tenant without the consent of the remainderman. For this reason, it is advisable to do any refinancing prior to executing the life estate deed.

- The remainderman’s creditors can record a lien on your property for the remainderman’s debts. However, that lien only extends to the remainderman’s interest. Your interest as a life tenant shall be respected. You cannot be kicked out of the house for the rest of your life.

- The remainderman can sell his interest, which means the buyer of the remainderman’s interest will take ownership of the property only after you die.

The decision on whether to execute a life estate deed should only be taken after conferring with your trusted attorney the most effective estate planning tool to use, given your circumstances. Should you need assistance in creating a life estate deed, we at the Law Offices of Albert Goodwin are here for you. We have offices in New York City, Brooklyn, NY and Queens, NY. You can call us at 212-233-1233 or send us an email at [email protected].