Executor vs administrator: the difference between executor and administrator of estate

The difference between executor and administrator of an estate in New York comes down to whether the will named them as an executor. When looking at executor vs administrator, a person whom the court appoints because they were named as an executor in a will is called an executor. A person whom the court appoints to manage the estate but who was not named as an executor in a will is called an administrator.

In New York, the person in charge of an estate can be called an executor or administrator. There are a few differences between them. The differences are not major. Many states have even abolished the executor vs administrator distinction altogether. Instead, they call any person in charge of an estate “personal representative.” The State of New York still has the executor vs administrator distinction.

Executor vs administrator are similar to “Ms. vs Mrs.” of New York estate law. The difference between Executor and Administrator of an estate is not big. But there is a difference, and it can be awkward and sometimes legally significant when misplaced.

What is estate executor

An estate Executor is someone who is in charge of an estate due to being nominated in the will. Being named as an Executor in a will in is not enough to start acting on behalf of an estate. You would first go through the probate process – submit the correct documentation, have the court appoint you as the executor and receive “Letters Testamentary from the Surrogate’s Court.”

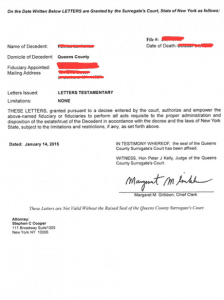

Letters Testamentary is a document has many safety features, such as watermarks. It looks similar to other New York documents that have to do with birth and death: Letters Testamentary look similar to a birth certificate or death certificate. The executor of an estate will receive Letters Testamentary from the Surrogate’s Court, which would look something like this:

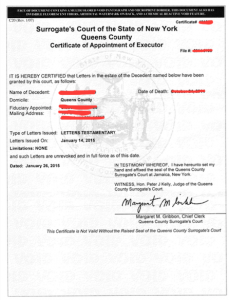

Once appointed, an executor will receive enough Certificates of Appointment of Executor to present to every bank and other institutions when they marshal the assets of the estate. The Certificates of Appointment also have watermarks and security features. The certificates cost $6 each, and you can obtain it from the cashier in the courthouse. The difference between executor and administrator of an estate is not a big one in this regard either. The certificates look very similar. The Certificate of Appointment of Executor of an estate (Executor of will) looks like this:

What is estate administrator

When no executor is available, the court will appoint a non-executor to manage the estate. We call this person an administrator.

The person most closely related to the person who died has the biggest preference in being appointed the executor of their estate. Here is the order of preference:

- spouse

- children

- grandchildren

- father or mother

- brothers or sisters

- and if none of those are found, then to the person who is entitled to the largest share of the estate (NY SCPA 1001(1)).

If no relative steps forward, then the Public Administrator of the county where the decedent lived steps forward and becomes the administrator of the estate. The Public Administrator is also involved in any estate where the administrator is a cousin, niece or nephew or further relationship to the decedent.

The court will appoint an administrator if the executor originally named in the will is not available. Not all executors are available to serve. They may be

- impossible to find

- no longer alive

- unable to serve as the executor for health reasons

- or just don’t’ want to serve as the executor

Serving as an executor is voluntary. It’s a task that requires time and energy commitment. Someone may not have even known that a person named them as the executor, and may have never had an interest in serving as one. A court cannot force a person to carry out the functions of an executor.

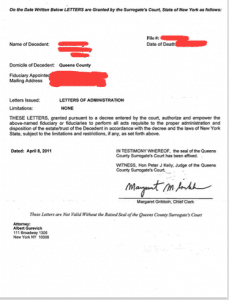

An Administrator will receive Letters of Administration from the Surrogate’s Court. Here is what the Letters of Administration look like:

The administrator of the estate will also receive Certificates of Administration from the court, as many as they request (at $6 each) to present to banks and other institutions when they marshal the assets of the estate. When looking at Executor vs Administrator, the documents issued by the Surrogate’s Court are pretty similar and have a similar effect. A Certificate of Appointment of Administrator:

A female administrator used to be called administratrix, and a female executor used to be called an executrix. The distinction has been eliminated by the courts. It is now against court rules to refer to someone as administratrix or executrix, only executor or administrator is allowed. Administratrix and executrix are terms that only pop up occasionally, in older wills that people made before this court rule went into effect.

Executor vs administrator: identical functions

Once the court appoints someone an executor or administrator, that person can start performing their duties per New York law.

The duties include things like finding (marshaling) the assets of the decent, paying debts taxes and fees and distributing the assets per the will. It is important to perform those functions correctly so that all beneficiaries receive their shares, and all proper creditors get their claims satisfied. Otherwise, the person in charge of the estate may risk being personally liable to the beneficiaries or creditors of the estate. There is no difference between Executor and Administrator as far as their basic functions. They are so similar that even though there is no such thing, we might as well call them executor administrator.

There is no such thing as an “executor administrator.”

There are more checks on the administrator than on the executor

When a person applies to be an Executor, all the court is doing is essentially confirming the decedent’s appointment. When a person applies to be an administrator, however, the court will do some additional checking.

A court appoints an executor without bond because most standard wills state that the executor can serve without bond. For administrators, however, the court is more likely to require a bond. A bond is insurance against theft or mismanagement involving the estate. The difference between the executor and administrator of an estate in this regard can come down to bond vs. no bond.

An administrator can be required to show their kinship

Another difference between executor and administrator is that the potential administrator may be required to show how they are related to the decedent. They would need to show the court that they are the closest living relative, and as such, have the preference to serve as the administrator. This is called “Kinship“.

The person applying to be an Administrator may be required to obtain consent from other relatives who are as closely related as the potential administrator is. Or they may be required to officially notify those relatives of their intent to become the executor.

The court may require a potential administrator to submit a family tree affidavit showing how the potential administrator is the closest living relative of the decedent. The family tree affidavit lists all the relatives of the decedent starting with their parents or grandparents.

In some situations, it may be sufficient to have a person with the knowledge of the family tree signed the affidavit. In other situations, the potential administrator may need to show documents in support of the family tree, such as birth and death certificates. Making family trees and showing such documents can be difficult, especially if the person who died or their ancestors immigrated to America from another country. The difference between executor and administrator of an estate is that the executor is less likely to be asked to show kinship. The executor is already named in the will, that’s all the proof the court may need.

An administrator is more likely to Be required to post a bond

Important Executor vs Administrator distinction: Most executors are not required to post a bond. Anyways, most wills explicitly state that the executor is not required to post a bond.

Administrators, on the other hand, are often required by the court to post a bond for the entire value of the estate.

A bond is an insurance that covers losses to the estate, with yearly payments to the insurance company that underwrites the bond. A person with a bad credit score would have more difficulty getting the bond and consequentially more difficulty becoming an Administrator of an estate.

Restrictions on the administrator

When an administrator is appointed, courts of most New York counties (i.e., Kings County) restrict their powers. For example, the court might restrict an administrator’s power to collecting only $200,000. Or, the court can restrict an administrator’s power to sell real estate such as a house. The court can require an administrator to make an extra application to the court to, for example, collect over $200,000 or sell a house.

If the beneficiaries are contesting the probate or administration, then the court can impose more restrictions on the administrator or executor. If there are people who object to the appointment of an Executor or Administrator, things get more complicated. The same goes for when the court is suspicious of something. If that happens, the courts may require additional proof from an executor or administrator before they get appointed, such as additional kinship information and a kinship hearing or a kinship trial. The court may also hold hearings on the qualification of the potential administrator or executor. Courts can place additional restrictions on appointment. A court can restrict the powers of an administrator. A court can require an executor to post a bond even if the will states that the executor is to post no bond. No difference between Executor and Administrator in that their powers can both be restricted or limited by the court.

Preliminary executor

When assets of the estate need immediate management, but there is a delay in the estate, the court will issue preliminary letters testamentary.

Delays happen for many reasons.

- beneficiaries are objecting to the appointment of the executor

- some documents are missing, and the court cannot appoint an executor without those documents

- Difficulty locating one of the parties that need to receive notice of the proceeding

- A delay in service of process

Preliminary letters testamentary give the executor the power to take care of the estate without giving them the power to disburse estate assets.

Courts are currently more reluctant than they used to be to appoint preliminary executors. The extra work puts a strain on the court’s resources. We are trying to not apply for preliminary executorship unless necessary in the case. The difference between executor and administrator in this regard is that there is no such thing as a preliminary administrator.” Only an Executor can be preliminary.

Notice to all heirs and potential heirs

Both potential executor and administrator have to give the proper notice to people affected by their appointment to that role.

If you wish for the court to appoint you as the executor, you would have to give notice of the probate proceeding to

- everyone who inherits under the will

- relatives who would have inherited if not for this will

- people who would have inherited under a prior will that was superseded by the current will

To notify people inheriting under the will, all you have to do is mail them Notice of Probate. For people whose prior inheritance rights are terminated by the will, you would need to have the court issue a Citation. You would need to have a process server deliver it personally upon them if they live in the State of New York. You can mail it Certified Mail if they live outside of the State of New York.

If you wish to get appointed as an Administrator of estate needs, you would be required to give notice to everyone who stands to inherit from the person who died (“distributees”).

To get appointed to be in charge of an estate, the potential executor or administrator would need to

- either obtain written waivers and consent of the people they notified

- or have to schedule a hearing date where the people notified of the date have a chance to appear and voice any of their reservations

Whenever you are trying to have the court appoint you as the executor or administrator, you would have to file the strict notice rules.

Affidavit of sole heirship

Whenever an Executor or Administrator is the sole heir of the decedent, they may be required to submit an affidavit of sole heirship. The affidavit of heirship can be signed by

- a non-interested party who is familiar with the family of the person who died

- a professional genealogist

- the attorney representing the executor, presuming the attorney conducted research into kinship and documented the research in the affidavit

The affidavit of sole heirship explains the family situation of the person who died and how it worked out that the person who died left only one heir.

Some states abolished the executor vs administrator distinction

About 12 States did away with the Executor vs Administrator distinction and call everyone personal representative. But in New York, the distinction still exists, so it is important not to mix up those two terms when it comes to the person in charge of the estate.

If you are trying to figure out the difference between executor and administrator of an estate, you likely require the services of a New York estate lawyer. We at the Law Offices of Albert Goodwin are here for you. We have offices in New York City, Brooklyn, NY and Queens, NY. You can call us at 212-233-1233 or send us an email at [email protected].