Intestate Succession in New York

Intestate succession in New York is one of the major reasons we encourage people to have a will. With a will, you determine where your assets end up. Otherwise, if you die without a will—intestate—you are stuck utilizing New York’s default intestate succession laws. Article 4 of the New York’s Estates, Powers and Trusts Law lists the order of hierarchy of the preferred beneficiary, child, and/or lineal descendant (known as “issue”).[1] Once a higher priority exists, the allocation stops and the more distant relatives end up with nothing.

| Closest Living Relative | Who Gets the Estate |

|---|---|

| A spouse and issue | Fifty thousand dollars and one-half of the residue to the spouse, and the balance thereof to the issue by representation. |

| A spouse and no issue | The whole to the spouse |

| Issue and no spouse | The whole to the issue of the parents, by representation |

| One or both parents, and no spouse and no issue | The whole to the surviving parent or parents. |

| Issue of parents, and no spouse | The whole to issue of parents |

| One or more grandparents or the issue of grandparents. . . . | |

| Great-grandchildren of grandparents . . . . | |

| If there are no qualifying descendants | the estate escheats to the state of New York |

“Issue” means linear descendants – children, grandchildren, and great-grandchildren.

Once a higher priority exists, the allocation stops and the more distant relatives end up with nothing. So for example, in intestate succession, if the person who died had a child, parents and siblings will not receive anything.

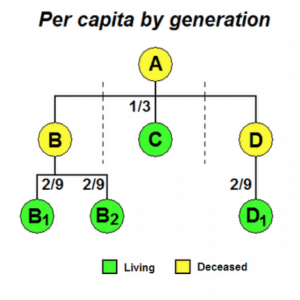

“By Representation means the same thing as “per capita by generation” – relatives at the same level of linear descent receive their shares equally, as illustrated below:

New York intestate succession law states that if you die without a will (“intestate”), your spouse takes the first $50,000 cut and then takes half of the remaining assets, with the other half goes to your issue—children and their descendants. While intestate succession may be desirable for some people, it may negatively impact your preferred allocation, especially if you had children from a prior marriage. Don’t forget that if you own your house jointly with your spouse, joint tenancy does not count towards this allocation—as the spouse will automatically have their interest enlarged. Additionally, the courts will impose additional incurred expenses for the estate to go through the intestate estate administration process, which is not present with a will.

The other issue that arises in intestate succession in New York is the division within your children – “by representation.” What does this mean? There are generally three ways a state may decide to divide inheritance: per stirpes, per capita, and by representation (or modern per stirpes). New York’s “by representation” model is similar to the per stirpes model, which differs only on the allocation of the first living relative before dropping the rest down. Here is an example to explain how this would work as per New York’s intestate succession laws:

Let us say that Bob passed away with $450,000 of assets after expenses. Bob was married to Wanda, his second wife with whom he shared a young daughter, Debbie. Bob also had three children from his prior marriage. Darryl, a notorious drug user; Manny, a multi-millionaire estranged from the family. He also had Beth, who tragically passed away, leaving four destitute children behind. Bob loved them as his own. In this example: First, Wanda takes $250,000 ($50,000 plus a half). The remaining $200,000 are divided: Debbie gets $50,000, Darryl gets $50,000, Manny gets $50,000, and Beth’s $50,000 flows to her children—her four children each get $12,500.

The above drastic example was meant to show the consequences of intestate succession law. Default laws do not care about personal circumstances. The law will treat the destitute, the millionaire, and the drug addict in the same way in intestate succession. If they are an “issue,” they will split the estate. While it is unlikely that anyone has it as bad as Bob, surely you can see where making your own rules makes more sense than relying on New York intestate succession law to determine how your estate gets distributed.

Let’s see what Bob could have done with a will. First, Bob leaves Wanda 1/3 of his estate, $150,000. This matches the minimum a surviving spouse is entitled to through the elective share rules.[2] He can now leave estranged Manny out entirely, he does not need the money. He can also leave $50,000 to Debbie—to prepay a year of college. Darryl will receive $50,000 on the express condition that he is drug free for a year—a great motivator! Lastly, Bob’s four destitute grandchildren from Beth also get $50,000 each.

With so many possibilities and intricate needs, there is no need to have New York’s default intestate succession law apply. Consider avoiding an intestate estate, by creating a last will and testament. If you need an attorney for your intestate succession case, call Albert Goodwin, Esq., a New York estate, guardianship, wills, trust, Medicaid and probate lawyer with over a decade of experience.