What is an Administrator of an Estate in New York City?

An administrator of an estate is a person who is appointed by the court to manage the estate of a person who died without a will.

Core Duties of an Administrator

The core duties of an administrator are:

- Apply to be the administrator

- Identify and inventory assets, which include real estate, bank accounts, investments, personal property, etc.

- Pay valid claims such as bills, taxes, funeral expenses, etc.

- Distribute remaining property to rightful heirs as per the intestacy law

Who Can Petition to be an Administrator

Under New York law, the following persons can petition to be an administrator, in order of priority:

- surviving spouse

- children

- grandchildren

- father or mother

- brothers or sisters

If the closest surviving heirs are the decedent’s cousins, New York’s Public Administrator petitions to be the administrator.

How Can I be Appointed as Administrator?

To be appointed as administrator, you can file a petition for administration. You will also need to file the accompanying documents.

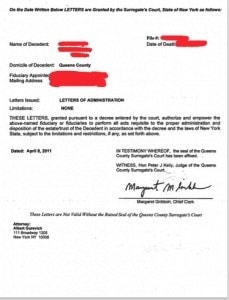

Letters of Administration

An administrator of an estate will receive Letters of Administration from the Surrogate’s Court. They look something like this:

The administrator of an estate also receives Certificates of Administration from the court, as many as they request (at $6 each) to present to banks and other institutions when they marshal the assets of the estate. This is what a Certificate of Appointment of Administrator would look like:

A female administrator of an estate used to be called administratrix but that definition no longer plays a role, as that distinction has been eliminated by the courts in favor of gender-neutral language. It is now against court rules to refer to someone as administratrix only executor or administrator is allowed.

The Responsibilities of an Administrator of an Estate

An administrator’s duties vary and may include the following:

- Managing the estate assets including bank accounts, stock, bonds, retirement accounts, pensions

- Taking inventory of assets, including personal and real property

- Investing assets

- Selling personal and real property

- Distributing assets

- Paying creditors and other claims including funeral expenses and any estate taxes that may be due out of estate assets

- Contacting an employer to find out about the testator’s employee benefits

- Managing the testator’s business

- Making accountings

- Communicate with the beneficiaries on a regular basis to keep them informed of important financial matters

- Resolving disputes that may arise between beneficiaries

- Winding up and settling the estate

There are all sorts of other contractual or legal matters that may require an administrator’s attention. For instance, if the testator owned commercial property and had tenants, the administrator may have to collect rents, work with a property management company or hire one depending on the size of the building and the number of tenants. The administrator may have to work with attorneys and accountants in order to make sure assets are properly valued and contractual obligations are completed.

An administrator is entitled to receive compensation for his or her services in accordance with the rates set by law. When a spouse or a family member acts as administrator, many times they do not take compensation for their services, especially when they are also a beneficiary receiving a distribution of assets under the will.

Affidavit of Sole Heirship

Whenever an administrator of an estate is the sole heir of the decedent, they may be required to submit an affidavit of sole heirship, whereby a non-interested party who is familiar with the family of the person who died or a professional genealogist or perhaps even the attorney representing the executor who did the right research signs an affidavit which explains the family situation of the person who died and how it worked out that the person who died left only one heir.

Administrator Commissions

Administrators are usually entitled to compensation. This compensation is called “commissions.” The amount an administrator is paid in New York is set by law, in SCPA 2307. Here are the commission percentages:

• 5% of the first $100,000

• 4% of the next $200,000

• 3% the next $700,000

• 2.5% of the next $4 Million

• 2% of the rest of the value of the estate

Fiduciary Duty of an Administrator

An administrator is held a higher standard of behavior and is expected to act in an honest, fair and ethical manner. If an administrator breaches their fiduciary duty, the administrator could be held legally liable for any losses suffered by the estate or beneficiaries. An administrator in New York can be removed by the beneficiaries for breach of fiduciary duty and could be subject to restitution of any financial losses to the estate and beneficiaries, as well as face criminal charges if the administrator committed any crimes such as embezzlement of estate assets.

Acting an administrator is a big responsibility, especially if an estate is large and has substantial assets. That is why some spouses or family members decide they do not want to take on the job and end up resigning and hiring an attorney or another personal representative to replace them and administer the estate.

If you are in a situation where an administrator of an estate is being appointed, you may require the services of a New York estate lawyer. I have been helping people deal with estates since 2008. If you need legal representation, we at the Law Offices of Albert Goodwin are here for you. We are located in Midtown Manhattan in New York City. You can call us at 212-233-1233 or send us an email at [email protected].